Analysis

Copier Careers 2019 Sales Manager Salary Survey

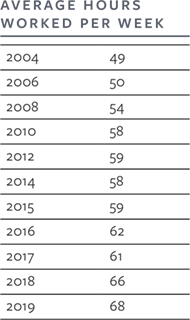

Every roaring success has a potential downside. For sales managers in the go-go Copier Channel™, the “downside” is the effort it takes to recruit, train and retain a top-notch sales force. In 2019, sales managers report working on average 68 hours a week, up two hours from a year ago. That might be why 94 percent of those who took our 2019 survey also said they are looking for a new position.

“It’s a challenging role. You’re a manager, you’re a psychologist, you’re a cheerleader, and you’ve got to be a numbers cruncher,” said Paul Schwartz, president of Copier Careers. “If you’re spinning plates, that’s a lot of plates to spin at one time.”

For sales managers, one of those plates — building a sales team — is much more difficult because of the extremely tight labor market. In May, the U.S. unemployment rate dropped to 3.6 percent. The New York Times found the hiring pinch is even tighter in the business services sector, which has added thousands of jobs because of new technologies.

Schwartz said he characterizes the mood among sales managers “more as frustration than dissatisfaction. It’s very hard to find people to hire. The No. 1 thing I hear from sales managers is about leaner teams, maintaining their teams and getting their teams to achieve quotas.”

The 2019 Sales Manager Salary Survey

Each year Copier Careers, the only nationwide recruiting firm dedicated exclusively to the Copier Channel, has asked professionals from across the industry about their compensation, job satisfaction and other work-life issues. Their responses reflect the challenges and opportunities sales managers see in the now mostly IT-based channel. Learn more about our company’s 30-year commitment to recruiting and hiring in the Copier Channel.

Copier Sales Managers by the Numbers

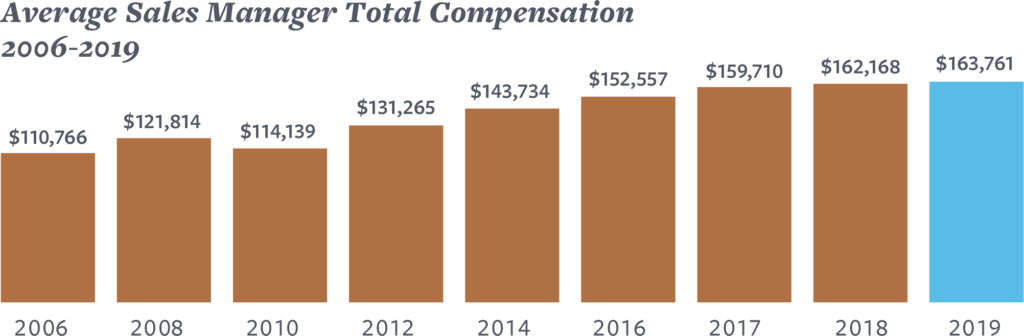

The average total compensation among the sales managers who took our online Sales Manager Salary Survey this year increased $1,593 to $163,761, or a 1.0 percent increase in base salary and commission. Traditional sales managers and selling sales managers are represented in this survey.

This compares favorably with average compensation for sales managers across U.S. industries. In its annual salary review, U.S. News & World Report found the national median for all sales managers to be $121,060 in 2017. U.S. News also ranked the job title “sales manager” as No. 2 on its list of “Best Sales and Marketing Jobs,” behind marketing manager.

As they did in 2018, Copier Channel sales managers were nearly unanimous in their focus on core issues. Ninety-nine percent of respondents indicated an interest in innovation, leading-edge technology and knowing that their work is important to the

company’s success.

“They are motivated,” said Jessica Crowley, business manager and senior recruiter at Copier Careers. “They realize that the more time and effort they put in, the more they are going to get back and get out of it.

“The industry is highly competitive, and they have to put in that much more time in order to get ahead by an inch, versus just letting things happen.”

2019 Salary and Benefits

This year, sales managers who responded to our survey have an average base salary of $63,739 and commissions totaling $100,022, for an average total compensation of $163,761 (+1.0 percent). The relatively flat compensation could explain why satisfaction with total compensation remained nearly identical to last year’s survey.

Responses to one of our online polls show that some sales managers also find rewards in the work beyond compensation.

“Accomplishment is motivation,” said one poll respondent. “Make that sale at the end of the month to push you over quota. Resolve a customer billing issue that saves the account and leads to a huge sale. Repair that device that has been plaguing technicians (and the customer) forever. … When you are part of a team and not out for yourself, great things happen.”

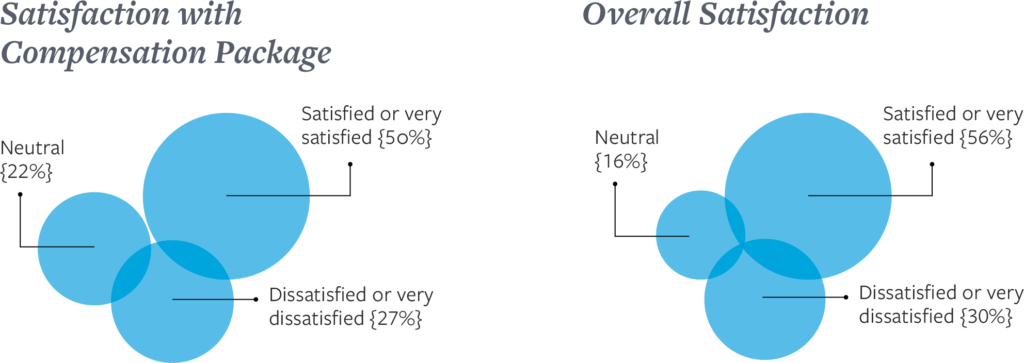

Mirroring 2018’s survey, 50 percent of respondents said they are “satisfied” or “very satisfied” with their total compensation. Twenty-two percent were “neutral” on the question, and 27 percent were “dissatisfied” with compensation, up 1 percentage point.

On overall job satisfaction, 56 percent of respondents said they were “satisfied” or “very satisfied,” a dip of 1 percent since 2018. Thirty percent were “dissatisfied” or “very dissatisfied,” with 16 percent of respondents “neutral” on the issue.

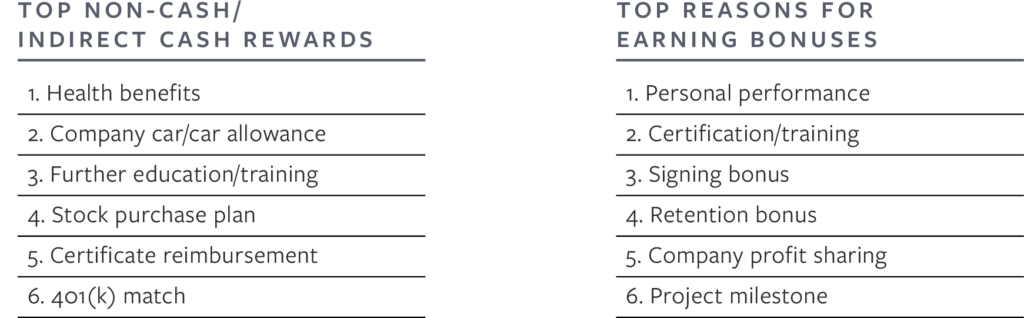

Of those who took the survey, 99 percent identified health benefits as their top non-cash/indirect reward, and 97 percent said they receive a car allowance or use a company car. Forty-five percent received a stock purchase plan, an increase of 12 percentage points, and 32 percent had a 401(k) match, an increase of 8 points.

The top three reasons for earning bonuses were the same as last year, with 96 percent of respondents citing personal performance; 78 percent received bonuses for certification or training; 68 percent received signing bonuses, an increase of 7 percentage points; 44 percent received retention bonuses, up 6 percentage points.

What Matters Most? One Word: Success

Being a sales manager is challenging. The job requires the ability to hire, inspire, train and lead a sales team to meet its quota again and again and again. Success is the core component of the sales manager’s psyche and job. In 2019, a deficit of candidates for sales teams has made that job even harder.

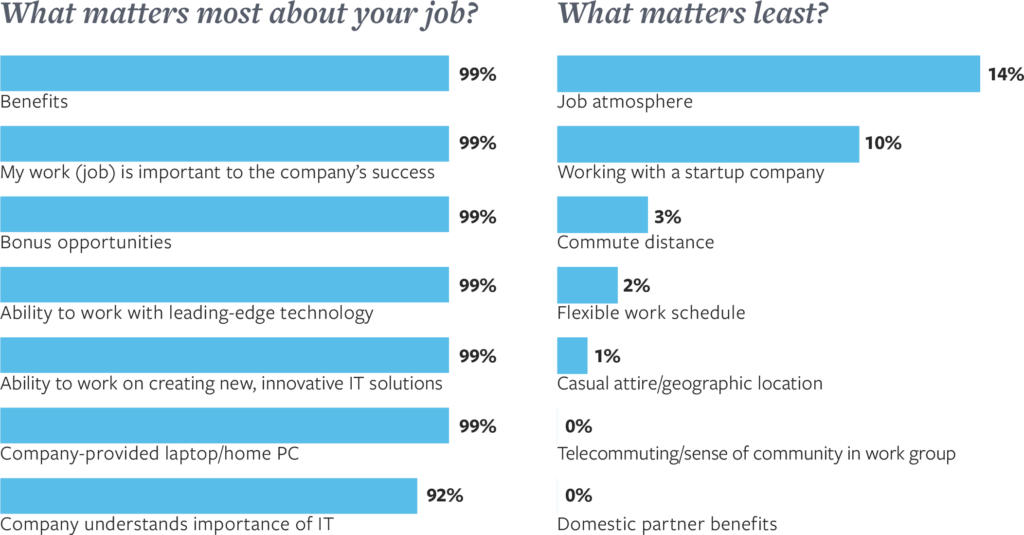

When asked to choose seven variables from a list of 37 factors that “matter most about your job,” 99 percent of those who responded to the survey pointed to the key components for building a sales team: bonuses, benefits, ability to work with leading-edge technology and innovative solutions, knowing their work is important to the company’s success, and a company-provided laptop. Not far behind, 92 percent pointed to the prestige or reputation of their company.

“This makes sense with the hard-charging nature of these sales managers,” Schwartz said. “They are trying to recruit people to the industry, to build a back bench, and they know those things are important to help bring people aboard.”

Crowley isn’t surprised that having a company-provided laptop was once again near the top of almost everyone’s wish list. “That shows they are working after hours, on nights and weekends,” she said, noting that is when a lot of planning and recruiting is done.

What Matters Least? Everything Else

If sales managers’ main focus is on success in their role and for their dealership, it would follow that they wouldn’t be too concerned about commute distance, casual attire, telecommuting or other “feel-good” job attributes. Only 14 percent of respondents to this year’s survey expressed interest in “job atmosphere.”

Only 41 percent of respondents said “vacation or paid time off” is important to them, a decrease of 5 percentage points. A higher number, 55 percent, said “commitment throughout the company to quality” matters to them, up 4 points.

For Schwartz, this is exactly what he would expect of these results-driven leaders. “Their focus is on building and maintaining a strong team,” he said. “This is the hardest thing to do, and we know how hard it is to find quality candidates who are producing and are willing to consider a change.”

An Industry Focused on Growth

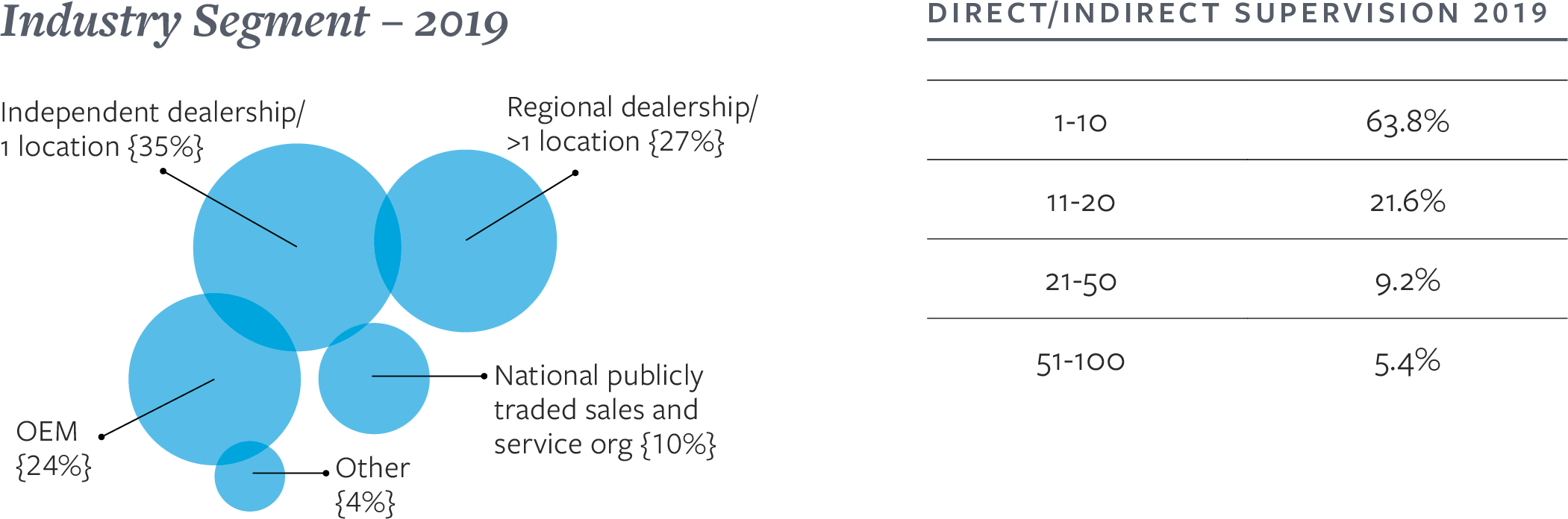

In 2019, of the sales managers who took our survey, 35 percent said they work at an independent dealership, down 2 percentage points from last year. Twenty-seven percent reported working at regional dealerships, an increase of 1 percentage point. Of the other employers, 24 percent of respondents worked at an OEM, up 1 percentage point; 10 percent worked at a national publicly traded sales and service organization; and 4 percent worked at some other organization.

Schwartz says the ticks up in the percentage of regional dealers and OEMs is part of a longtime trend. “The typical model in this industry is local to regional dealerships. It’s why there are so many mergers and acquisitions, because it’s a fast way to grow,” he said. “If you go buy somebody else and you acquire their base, that gives you a client base to start working with to grow it some more.”

From 2002 to 2019, the proportion of sales managers who said they work at regional dealerships with more than one location increased from 4 percent to 27 percent. It’s a trend that Schwartz thinks will continue.

“Not all, but the vast majority of our clients want to grow,” he said. “That is why we will see more mergers and acquisitions in the future. The way to succeed in the industry is to grow.”

Larger Dealerships. More People to Supervise.

This year’s survey also shows some small changes in the number of people whom sales managers supervise. Of those responding to this year’s survey, 63.8 percent supervise 1-10 people, a decrease of 1.7 percentage points. Those who supervise 11-20 people increased to 21.6 percent, up 1.6 percentage points; and the proportion of those supervising 21-50 people increased slightly to 9.2 percent.

As we observed in last year’s Salary Survey, the growth of regional dealerships has corresponded year-over-year with the increasing number of employees being supervised. Those who manage 11-20 people increased slightly, from 20 percent in 2018 to 21.6 percent this year.

But continuous growth through mergers and acquisitions can make a sales manager’s role even more difficult. “For sales managers, companies are looking not only at track record but at the sales manager’s drive to build new business,” Crowley said. “As companies are acquired, obviously their force is growing, and the sales manager has to figure how to compete with conglomerates. It’s going to be by continually building their team and increasing their company’s market share.”

“ We are currently staffed well in sales, but with the turnover, we lack the proper connection with our current clients.”

The 68-Hour Workweek

Ouch. This year, sales managers who took our survey report working on average 68 hours per week — a two-hour increase from last year. Even for hard-charging, success-driven pros, that is a lot of hours. That is 10 hours more per week than in 2010 and 22 hours more per week than they reported working in 2002. What is going on?

“Recruiting and hiring,” Crowley said. “They are putting in so many hours, because their time is spent with the sales reps in the field. Then after hours and on weekends, they are recruiting. That’s why they are working 68 hours.”

It is not only the dearth of candidates, but in such a competitive marketplace, sales managers are being cautious in whom they hire, because results are so critical.

“Because you are successful in one organization doesn’t mean that you are going to be successful at another,” Crowley said. “It’s also a gamble for sales managers to hire people without industry experience. They have to trust their gut or the metrics to help them build the best team possible.”

Crowley said that beyond their recruiting efforts, sales managers rack up extra hours

training and onboarding new staff and devising strategy to compete with larger companies to build their market share.

“They constantly work on plans to build the team they want,” she said. “This involves everything from determining how many non-industry people they want to add to the team and how many tenured individuals they need, and how they lead and manage the two different types of candidates.”

In 2019, Copier Channel sales managers share a long workweek with their peers in other industries. An article on the Hub Spot blog says, “28 percent of sales managers/VPs are working more than 60 hours per week.” The Bureau of Labor Statistics reports, “Most sales managers work full time, and they often have to work additional hours on evenings and weekends.”

The Trouble with Turnover

“Turnover” is probably the word that keeps sales managers awake at night. In the current marketplace, replacing a sales representative is a top issue for many dealers. There just aren’t enough qualified candidates in the pipeline. An added concern is that talented sales reps’ skills are highly transferable — not only within the industry but outside it, as well.

“I have a sales rep who is looking to make a move because there is so much turnover within their sales department,” Crowley said. “He has only been in the industry seven months, and he feels invisible because the sales manager is out there making calls or trying to recruit, and the attention is not on people who are working there.”

From the sales manager’s perspective, dissatisfied sales reps pose a constant worry, Schwartz said. “They onboard people and need to onboard more, but they don’t have time to ramp them up. So, something gives and they have phenomenal turnover. The cost of making a hire every six or eight months can be devastating to a company.”

A poll respondent said much the same about turnover at his dealership. “We are currently staffed well in sales, but with the turnover, we lack the proper connection with our current clients.”

Are you looking for a new job> & Why are you looking for a new job?

It’s ‘Show Me the Money’ Time

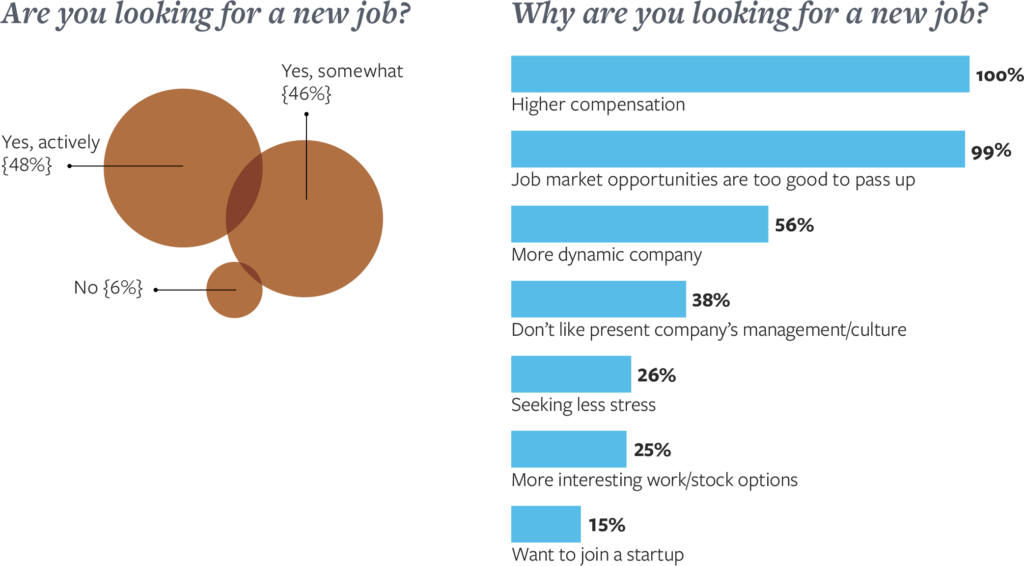

Compensation is the main reason sales managers say they are ready to change jobs. It has been the top reason for “looking” since we began our salary surveys in 2002, when 82 percent of respondents said they were “looking for a new job.” In 2008, 91 percent said they were “looking” for higher compensation and that number hovered in the 90s until 2017, when 100 percent of survey respondents said it was the top reason that they were looking for work. It has remained at 100 percent for the past three years.

In 2019, there also was a 1 point increase among those who say they are “actively looking” for a new job, bringing to 94 percent the number of sales managers who say they are open to new opportunities. Only 6 percent of those responding to this year’s survey indicated that they are not looking for a new job, down 1 percentage point from 2018.

But why would people who make good money and have a big stake in their company’s success be ready to move on? After compensation, 99 percent of respondents cited “job opportunities too good to pass up.” Fifty-six percent of respondents want to work at “a more dynamic company,” and 25 percent want “stock options,” an increase of 3 percentage points from last year.

For people geared to create teams that succeed, Schwartz said that the difficulty in finding qualified candidates has become increasingly frustrating.

“They are held accountable,” Schwartz said. “Not only is a big chunk of their comp based on how they produce but also on how their team produces. If they can’t build a team because candidates are scarce, it creates an extra level of difficulty in an already high-pressure job.”

One online poll respondent put it this way: “While total compensation is an important part of the equation, the day-to-day operations of the company (i.e. the culture) is what ultimately affects your job satisfaction.”

That fit was acknowledged by the 38 percent of respondents who don’t like their “present company’s management or culture,” up 1 point from last year. Twenty-six percent of respondents said they are “seeking less stress,” an increase of 3 points from 2018.

“More and more, we hear from managers who are sick of managing and they just want to be an individual contributor again,” Crowley said. “They know that they are motivated and that they can be successful without the hassles of being a manager.”

“ We have seen the industry adapt, innovate and grow exponentially over the past 15 years. We know it will adapt and find new ways to bring people into the industry. Continued growth depends on it.”

Amped Up and Ready to Hire

When asked to describe sales managers, Schwartz said: “They are amped-up people who tend to motivate and inspire other people. They are more than Type A personalities; they are A plus-plus-plus.”

But in 2019, even though sales managers are amped up to hire and build their sales teams, there simply aren’t enough candidates to meet the demand. That deficit is causing an imbalance that could stall the Copier Channel’s incredible growth. Clearly, it is an industry-wide issue and therefore demands an industry-wide solution.

“Finding more qualified sales reps to hire is the answer,” Schwartz said. “The big question is how to attract them to the industry.”

Schwartz said that big questions are something the industry has learned how to address. Take, for instance, its rapid evolution to an IT-based business in recent years. “We have seen the industry adapt, innovate and grow exponentially over the past 15 years. We know it will adapt and find new ways to bring people into the channel,” Schwartz said. “Continued growth depends on it.”

“As recruiters, we know how tough it is to find qualified candidates right now, but our specialty is finding those hard-to-find candidates, and we are all-in on the search.”

In the meantime, he said that dealers should cut sales managers a little slack. After all, they have a lot of plates spinning, as they scramble to make good hires and keep their teams motivated and performing well. Even top performers who are willing to put extra hours into creating success can get tired and frustrated.

“It’s a very hard role to fill,” Schwartz said. “We’re hearing a lot of frustration out there, and we’re seeing it in our Salary Surveys. Now, it’s time to do what the Copier Channel does best, and that is adapt and move forward.”

Stay Tuned for Our Other 2019 Salary Surveys

- August Service and Operations Managers Salary Survey

- December Sales Representatives Salary Survey

In Case You Missed It

- Check out our 2019 Copier Tech Salary Survey

ABOUT US

Copier Careers® is a recruiting firm dedicated exclusively to helping Copier Channel employers find experienced service techs, copier sales reps, sales managers, service & operations managers, controllers, back-office staff and MPS/MNS experts. Learn more about our commitment to the Copier Channel at CopierCareers.com or call 888-733-4868 to talk with a recruiter.