Analysis

2018 Service and Operations Manager Salary Survey

Service and operations managers are meeting the challenges and increased responsibilities of the rapidly evolving IT-based Copier Channel. As they implemented a tidal wave of new solutions over the past decade, their confidence and rewards grew. They now see success as a cross-functional, cross-departmental construct. In this year’s survey, service and ops managers take pride in their value to the company, and many aspire to play a larger role in developing strategy and increasing collaboration to build even more success and rewards.

In 2018, service and operations managers say their salary and rewards remained stable, with small increases over 2017. More than three-quarters of survey respondents say they receive bonuses for personal performance and earn stock options. However, only 46 percent are satisfied with their job overall, and 98 percent say they are open to new opportunities.

The relatively low satisfaction could spring from an industry-wide scarcity of qualified job candidates, which forces managers to spend a lot of time recruiting. The willingness to think about changing jobs can be attributed to a red-hot industry rife with opportunities.

Survey responses also reveal genuine engagement in their work, with 100 percent of

respondents saying they want to work with leading-edge technology. They also express high interest in understanding their company’s business strategy, which offers ownership insight into how it can increase satisfaction and keep skilled managers on their team.

2018 Service and Operations Manager Salary Survey

Since 2002 Copier Careers®, the only nationwide recruiting firm dedicated exclusively to the Copier Channel, has asked professionals from across the industry about their compensation, job satisfaction and other work-life issues. This year 1,995 Copier Channel service and operations managers from across the industry participated in our survey, an increase of 68 participants. Their responses reflect an evolved IT-based channel faced with maintaining or improving service in a challenging market for qualified candidates.

In this year’s survey, service and operations managers show great commitment to their work and enthusiasm to embrace new solutions. They clearly know that they have a key role in the industry’s growth and prosperity, and they are open to greater collaboration with peers across the company:

- 78 percent say they want to work with “highly talented peers,” an increase of 12 percentage points over 2017 and 27 percentage points more than in 2016.

- 74 percent say they want to feel “a sense of community in my work group,” an increase of 13 percentage points in the past year. This is 40 percentage points more than in 2016, which illustrates the trend of Copier Channel professionals to move out of siloed work specialties toward developing more cooperative work groups across organizations.

“Whether it’s working on a massive project or day-to-day tasks, working with highly talented peers has grown in importance as solutions have become more sophisticated,” said Jessica Crowley, business development manager and senior recruiter at Copier Careers. “They need to work with people at the same level to continue to evolve.”

As in last year’s survey, a big majority of respondents (89 percent) point to the effectiveness of their immediate supervisor as an important factor — an increase of 8 percentage points. Eighty-nine percent of respondents also point to the need to have “tools and support to do my job well,” an increase of 12 percentage points over last year’s survey.

Clearly, these industry pros are focused on forward momentum and want to better implement and service IT solutions, because they know it is critical to their organization’s success.

Salary and Satisfaction

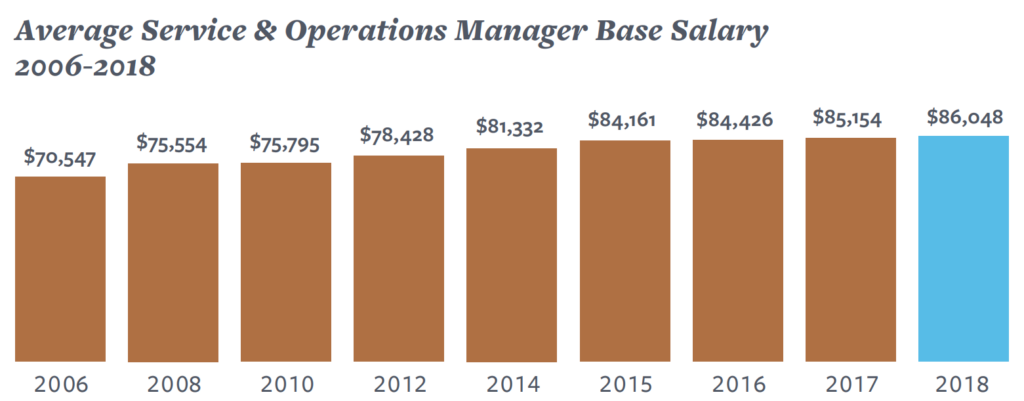

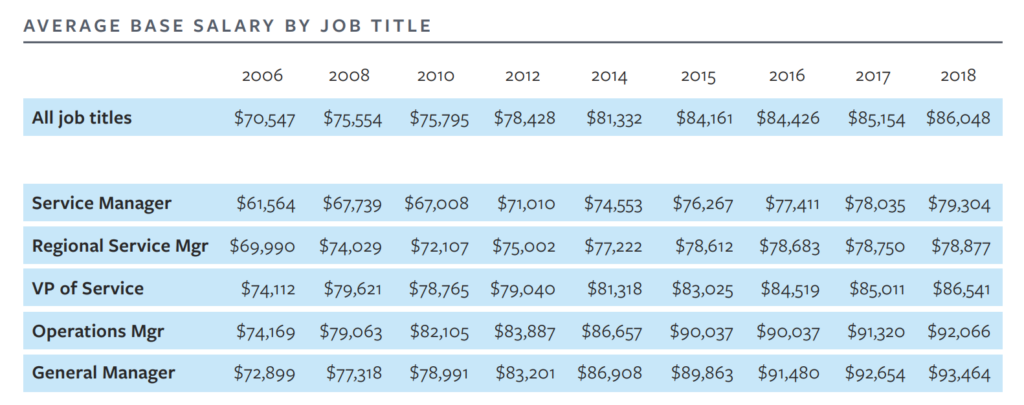

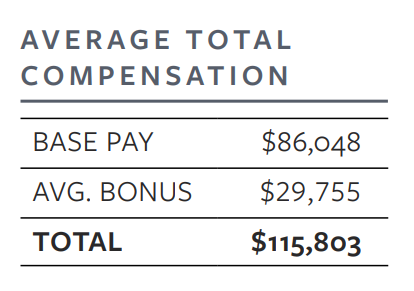

The average annual salary across all job titles for service and operations managers increased 0.9 percent to $86,048 in 2018. That is nearly $20,000 above the national average base pay for service and ops managers compiled by Glassdoor.

Non-cash bonuses for health benefits, a company car, training, etc., increased 3.8 percent to a value of $29,755 (+$1,100), bringing average annual compensation across all service and operations manager job titles — including non-cash perks — to $115,803, an increase of 1.75 percent.

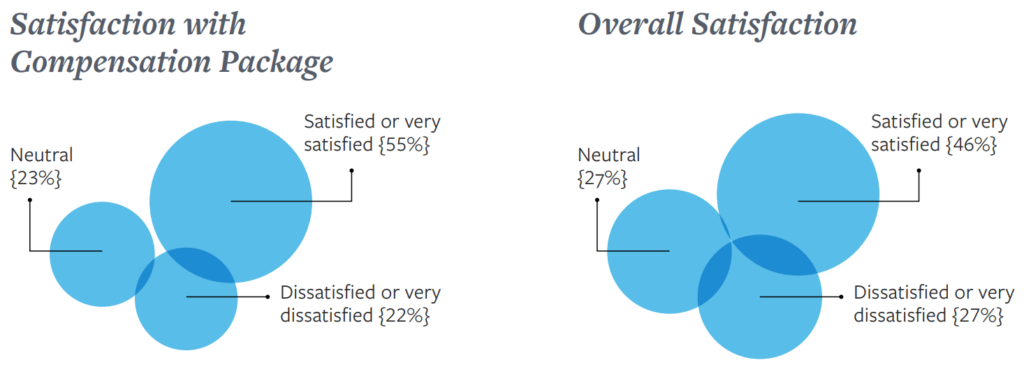

More than half of respondents, 55 percent, said they are “satisfied” or “very satisfied” with their overall compensation, 23 percent were neutral on compensation and 22 percent said they were “dissatisfied.” Compare that with overall job satisfaction, where fewer than half of service and ops managers said they were “satisfied” or “very satisfied,” 46 percent; 27 percent were neutral on overall job satisfaction, and 26 percent said they were “dissatisfied” or “very dissatisfied” with their job.

With more than half of respondents saying they are satisfied with compensation but fewer than half satisfied with their job overall, it could indicate that something about the job is causing lower satisfaction. In 2018, it could be the challenge of finding and hiring qualified staff members, or it could point to the industry’s ongoing effort to balance work and rewards in the more collaborative workplace.

Technology and Change

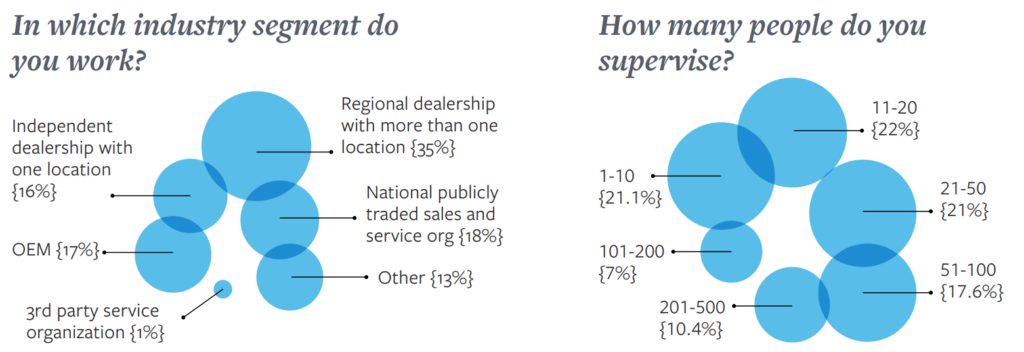

In 2018, service and operations managers who took the salary survey are working in basically the same proportions across the industry, with the greatest number working in regional dealerships with more than one location.

Similarly, the proportions of how many employees and contractors they supervise remains almost evenly split across categories, but overall, service and ops managers are supervising more people because of growth across the industry.

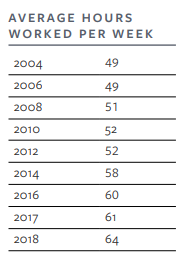

One notable change for service and ops managers in 2018 is the time they spend at work. Survey respondents noted that on average they now work 64 hours per week, up three hours since last year’s survey or +4.9 percent, and a dozen more hours than their workweek a decade ago.

Technology is at the heart of that change, Crowley said. “It’s a combination of the number of products, services, solutions and the training needed to keep technicians up to speed. Service and ops managers also have a constant need to recruit to build their service departments and attract individuals with more of an IT background.”

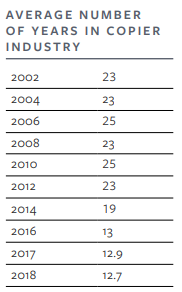

Another change in the 2018 survey is the average number of years that service and ops managers have been in the industry. In 2018, the average tenure of respondents was 12.7 years. This is less than half the time in the industry reported by service and ops managers in 2011, when their average tenure was nearly 26 years.

Crowley said this change reflects wider changes in the industry. “In the past five years, a lot of people decided to retire rather than tackle all the challenges of changing technology,” she said. “More recently, many baby boomers who grew up in the industry have reached retirement age, and the people filling their jobs have fewer years in the industry but more IT experience. So the workforce has evolved along with the technology.”

When asked how long they plan to stay with their current company, respondents to this year’s survey said four years, a decrease of one year from last year’s survey. However, that response aligns with a report by the U.S. Bureau of Labor Statistics that says the average American worker now changes jobs every four years.

“The type of person who does this work generally handles stress well or even thrives on it.”

Responsibility and Rewards

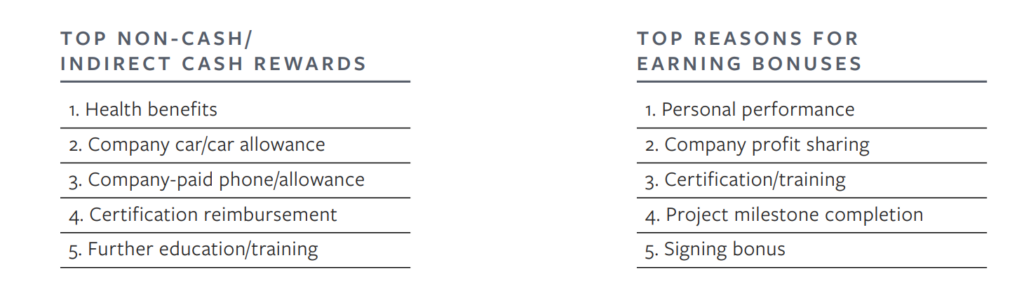

Of the service and operations managers who responded to this year’s survey, they identified the same top non-cash/indirect cash rewards as last year. All respondents said they receive health benefits, 99 percent have a company car or car allowance and as in previous surveys, more than three-quarters of the respondents say they are reimbursed for certification and further training.

The top reasons for earning bonuses in 2018 also remained the same; however, 67 percent said they received bonuses for project milestones, an increase of 9 percentage points; and 48 percent of respondents said they had been given a signing bonus, an increase of 7 percentage points. This could indicate that dealers and owners are sweetening perks to attract or retain these employees.

Service and ops managers have been a linchpin as the industry rocketed away from its break-fix days to an IT-based solutions landscape. The ability to hire, train and coordinate staff to implement solutions requires tenacity and creativity, and some industry professionals say a lack of training, staffing or support can be problematic.

“It’s hard to service equipment when you don’t have the parts you need and support from management,” said an online commenter. “It seems the go-to solution is to blame the technicians, which creates a problem retaining good technicians.”

In a tight job market, keeping staff engaged, ownership happy and clients satisfied is a stressor for these managers. In this year’s survey, 34 percent of respondents said they are looking for a new job because they are seeking less stress, an increase of 4 percentage points. But nearly as many respondents said they are looking for a new job because they want more responsibility — which could lead to more stress. More responsibility also can bring greater rewards and more authority to manage the work.

Rapid change in the industry has been a stressor, but from her experience, Crowley said that stress generally has not been an issue for service and ops managers.

“They are getting recognition for what they are doing,” she said. “They are getting bonuses based on benchmarks, projects and milestones that they complete. Their compensation reflects the time and effort they put in. The type of person who does this work generally handles stress well or even thrives on it.”

Evolving Ideas About What Matters Most

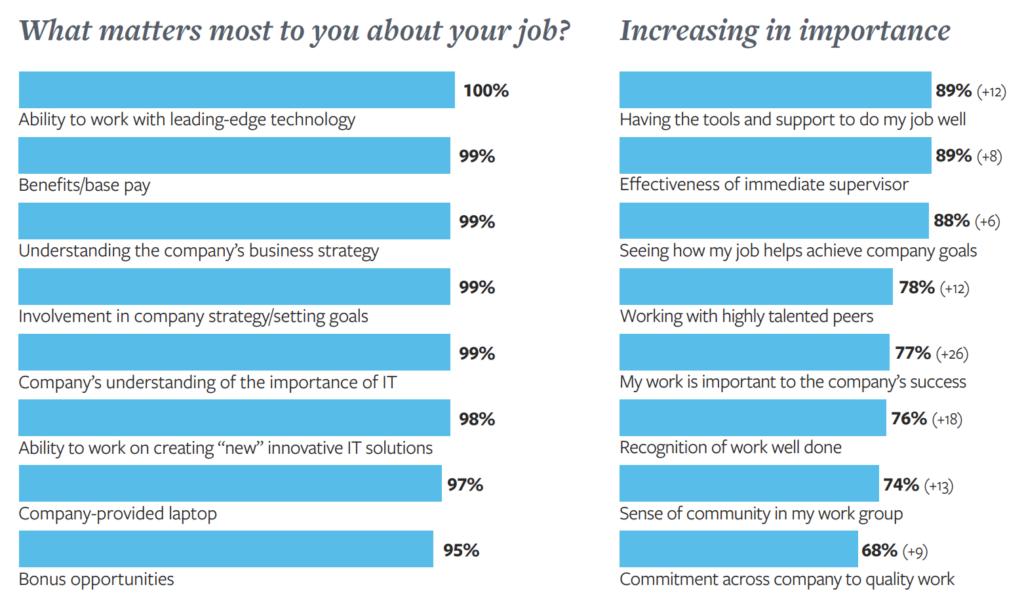

Each year, survey respondents are asked to identify seven factors “most important to your job” from a list of 37 variables. Year over year, many of the same factors top the list. This year, all respondents pointed to “the ability to work with leading-edge technology” as the thing that matters most to them. It dislodged “base pay” from the top spot in last year’s survey. Of the variables, another nine were identified by 90 percent or more respondents as important to them (table above).

What is particularly interesting is not the predictable top 10 but the factors that are increasing in importance year over year. Many of these factors grew in importance to respondents by double digits this year. They include variables about feeling engaged, valued and equipped to do their best work:

- 89 percent want the tools and support to do their job well, an increase of 12 percentage points

- 78 percent want to work with highly talented peers, also up 12 percentage points

- 77 percent want to know their work is important to the company’s success, an increase of 26 percentage points

- 76 percent want recognition for work well done, an increase of 18 points

- 74 percent want a sense of community in their work group, up 13 points

- 68 percent want a commitment across the company to quality work, up 9 points

It seems that the advance of IT solutions forced Copier Channel professionals out of their silos, because they needed to collaborate to succeed. Now that cross-pollination has begun to feel normal, service and ops managers are among those who see the value it brings, and they want to keep collaborating with their peers.

“Historically, there has been tension between the sales and service departments,” Schwartz said. “In the past decade, each side has come to rely more on the other. Now the sales team understands that it can’t succeed without service, and service managers recognize they can’t be successful without sales.”

A Red-Hot Candidates’ Market

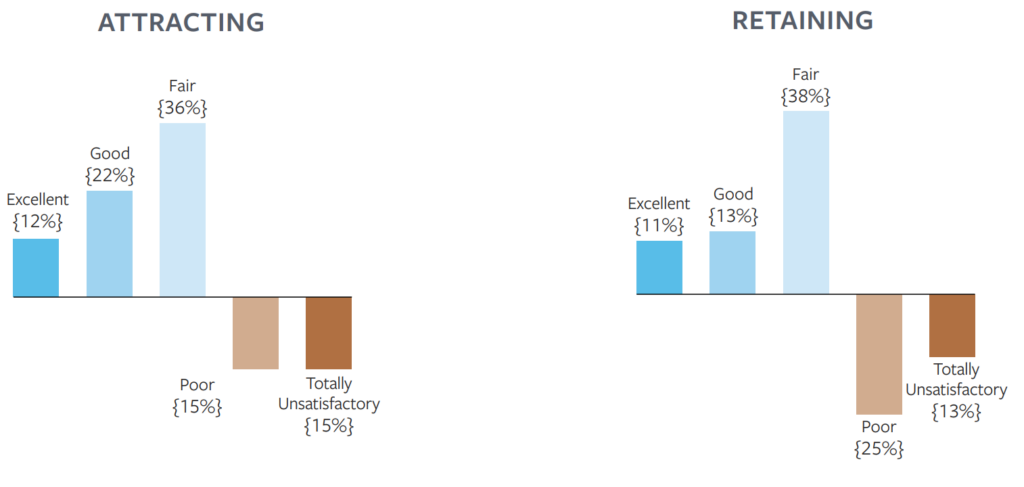

Across the industry there is a shortage of qualified candidates to fill open jobs. For dealers, the challenge is to attract new talent and retain the copier pros they already employ. In this year’s survey, 70 percent of service and ops managers gave their employers a passing grade on “attracting employees.” Of the total, 12 percent said their company is “excellent” at attracting talent, 22 percent said their company does a “good” job, and 36 percent rated their company as “fair” at attraction. Nearly a third of respondents (30 percent) said their company does a “poor” or “totally unsatisfactory” job of attracting talent.

Respondents gave employers slightly lower scores on retention, with 62 percent saying their company does it successfully. Of those, 11 percent rated their company’s efforts as “excellent,” 13 percent rated retention as “good,” and 38 percent rated the effort as “fair.” More than a third of respondents (38 percent) said their company’s retention is “poor” or “totally unsatisfactory.”

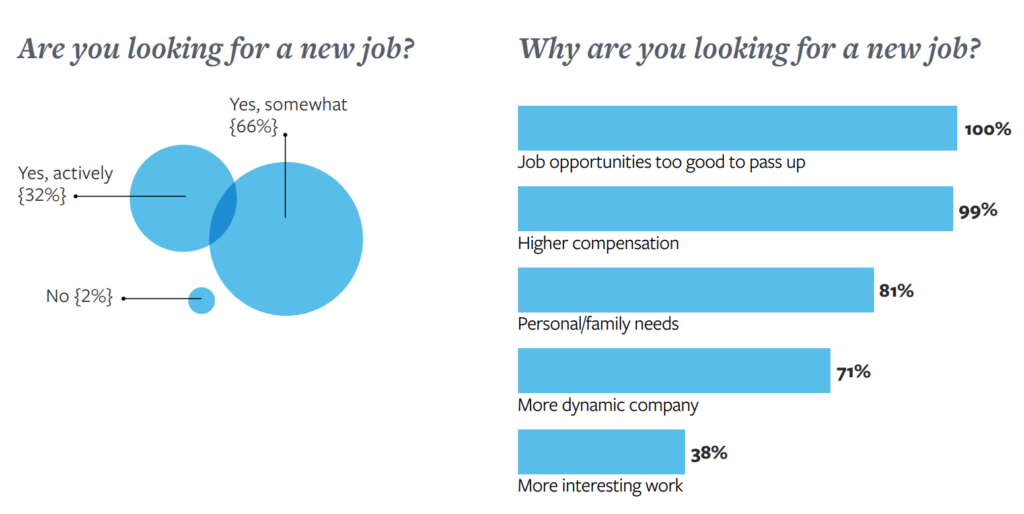

“Whether it’s correct or not, there is a perception that the market is too good not to look,” Schwartz said, noting that 98 percent of 2018 survey respondents said they are open to new opportunities. Add to that acquisitions and organizations that want to grow organically and are creating new positions, and the supply and demand equation becomes clear.

“Candidates are seeing opportunities for growth,” Crowley said. “If they don’t see that in their current position, if they don’t get support from leadership or ownership — they know that they have options.”

She said it’s important to remember that in the evolved IT-based industry, recognition matters. Copier Channel professionals want to be appreciated and rewarded for the value they add to the company’s bottom line. In this year’s survey:

- 77 percent want to know their job is important to the company’s success, an increase of 26 percentage points

- 76 percent want to be recognized for work well done, an increase of 18 points

- 68 percent want commitment throughout the company to quality work, an increase of 9 points

The takeaway is that the expectations of Copier Channel professionals have changed along with the industry in recent years. The key to successful recruiting and retention might be tuning in to the signals employees are sending.

Once again, nearly all of the service and operations managers who responded to the survey (98%) said they’re either “actively” or “somewhat” looking for a new job. And this year they are all certain of one thing — 100 percent of respondents said there are “job opportunities that are too good to pass up.”

In the red-hot job market, people are looking for the right fit — or for something they can’t achieve in their current position, Crowley said. “When I talk to people, it’s not only base salary and potential for bonus. They are asking above-and-beyond questions. They are looking for a more dynamic company, and they are interested in growth in the position.”

In May, Crowley led a session on “How to Recruit in the Changing Workforce” at the CDA Service and Operations Management Meeting, where she fielded a host of questions about attracting and retaining talent.

The most frequent question was what dealers should do to attract the talent they need. Her answer was also a question: “What are you providing to clients that would entice people from inside or outside the industry to want to work for you?”

In an industry with increased focus on collaborative work, Crowley said she points to the “what matters most” list to better understand what potential employees value in a work environment. “They want the authority and support to shape their team. They want to work with leading-edge technology, and they want to be recognized for their contributions,” she said. “And they want the tools and support to do their job well.”

She noted that while 66 percent of respondents said they are “somewhat looking” for a new opportunity, because they see such need for talent across the industry, that doesn’t mean they are ready to move on or are determined to stay. They are passive candidates, who are keeping an eye out for an opportunity that is a great fit for their talents.

That is when the experience of a skilled recruiter comes into play, Crowley said. “My goal is to match a candidate’s needs with the right employer and to present solutions to our clients to best meet their hiring needs.” She noted that in recruiting and hiring, timing is always a critical factor — especially when you’re looking for the right fit.

“That’s why we encourage our clients to consider proactive hiring,” she said. “It’s important to talk with well-qualified candidates when they are open to new opportunities. My job is to determine what a passive candidate needs to turn them into an active candidate and then find an employer that is a great fit.”

“They are taking pride and more ownership in the success of the totality of the business.”

“The silos are gone. The era of collaboration has begun.” That was the key takeaway from last year’s Service and Operations Manager Salary Survey. Results from this year’s survey confirm that conclusion. Across many variables, service and ops managers indicate they view success in their work as a collaboration with colleagues across the organization. Having left their silos behind, Copier Channel professionals have embraced collaboration and co-working.

“My sense is that they are taking pride and taking more ownership in the success of the totality of the business,” Schwartz said. “Having a more global vision and not just focusing on just their niche makes their work part of a bigger puzzle. They are taking great pride that their piece affects all the other pieces.”

But along with that “pride of ownership,” Copier Channel pros also have developed new expectations. They increasingly want a say in strategy and to be recognized and rewarded for their contributions. They also understand how their work adds value to an organization’s success.

In a tight job market, understanding changing expectations and meeting them could make a difference in attracting and retaining top talent. Those expectations can be a guide to how to sustain growth across the Copier Channel.

Also noteworthy from this year’s survey is that respondents expressed a deep level of engagement and interest in creating greater success for their company. This is especially impressive because these pros see a plethora of lucrative job opportunities. It would be easy to move on, but they are offering insights into how to grow the business and attract and retain staff. They see potential to solve problems, create solutions and increase their company’s profits.

This year, it seems that service and operations managers are sending a message. It’s about working together. In a collaborative environment. Your success is my success. -CC

Stay Tuned for Our Next 2018 Salary Survey

- December – Sales Representatives Salary Survey

In Case You Missed It

Copier Careers® is a recruiting firm dedicated exclusively to helping Copier Channel employers find experienced service techs, copier sales reps, sales managers, service & operations managers, controllers, back-office staff and MPS/MNS experts. Learn more about our commitment to the Copier Channel at CopierCareers.com or call 888-733-4868 to talk with a recruiter.