Analysis

2019 Service Technician Salary Survey

The Copier Channel can duplicate almost anything — except what it needs most urgently: qualified copier technicians. In 2019, the demand for copier technicians continues to surge, while the pool of qualified hybrid techs has dwindled. And there is no relief in sight.

The lack of available candidates is due in part to a historically low U.S. unemployment rate, which stood at 3.6 percent in April — the lowest since 1969’s 2.5 percent.

“Our industry has always been very close to a zero-unemployment environment,” said Paul Schwartz, president of Copier Careers. “But it’s tighter now, because this industry is growing — and it’s not doing a good job of building a back bench.”

What Schwartz calls “a perfect storm” in the copier industry mirrors the wider U.S. economy. There are more jobs requiring tech skills than there are people with the skills to fill them. Forbes describes it as a skills gap that is keeping U.S. technology companies from growing.

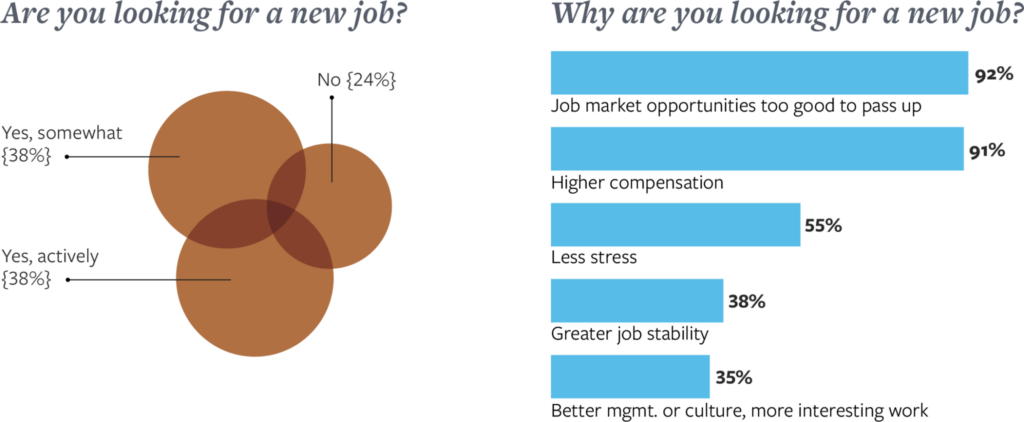

Scarce candidates for tech jobs in the Copier Channel is much like that wider trend. Our survey shows that 76 percent of respondents are looking for a new job. Anecdotally, our recruiters have heard of a significant increase in counteroffers to retain techs. But that stopgap fix can lead to other tensions for technicians and leadership. The real solution is to bring in new people by rethinking and rebooting the industry’s training and hiring practices.

The 2019 Copier Technician Salary Survey

This is the 17th year that Copier Careers, the only nationwide recruiting firm dedicated exclusively to the Copier Channel, has asked professionals from across the industry about their compensation, job satisfaction and work-life issues. This year 4,785 copier techs from across the industry participated in our survey, an increase of 45 respondents from 2018.

In 2019, it’s all about having options. Businesses inside and outside the Copier Channel are finding fewer options to fill positions that require workers with tech skills. By contrast, skilled IT techs are finding abundant opportunities to flex their professional muscle. It’s a candidate’s market with high demand and a very limited supply.

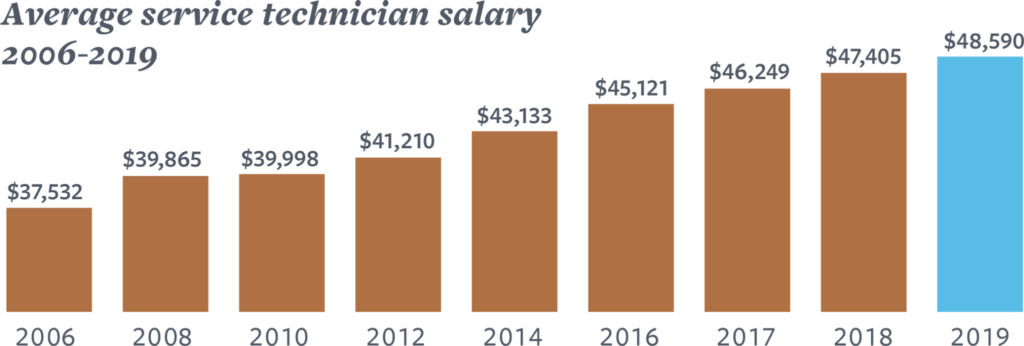

Our 2019 online survey generated responses from 4,785 copier service technicians, who described their pay, benefits, job satisfaction and other work-life issues. While pay ticked up to $48,590, about $1,200 more on average for copier techs than in 2018, it has not increased their willingness to stay where they are.

Seventy-six percent of those who took the survey said they are “actively” or “somewhat” looking for a new job, an increase of 4 percentage points over 2018. And 92 percent of respondents say they are looking for work because there are opportunities too good to pass up, an increase of 3 percentage points over last year’s survey.

“I think techs are starting to realize how much value they bring to the organization,” said Jessica Crowley, business development manager and senior recruiter at Copier Careers. “It’s a very small community. If techs start talking about the compensation, leadership or culture in one company with a friend in another company, and they know the other tech has less stress and frustration in getting the job done, they are going to start entertaining opportunities.

“It’s not just about the money; it’s really about being valued by the organization,” Crowley said.

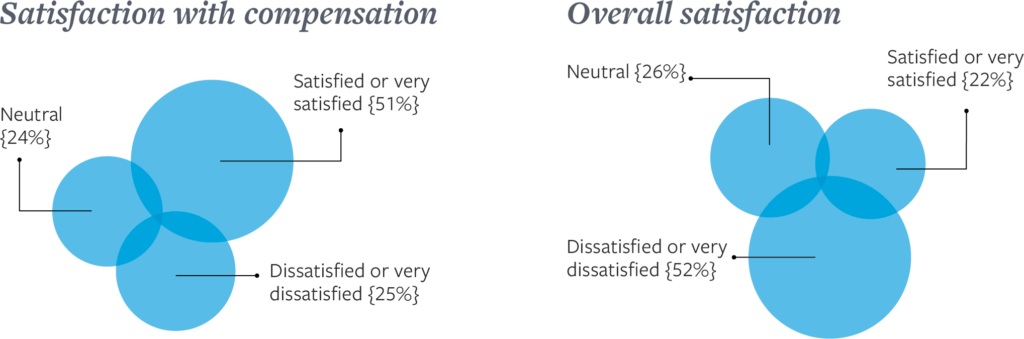

The responses to this year’s survey seem to support that. While 51 percent of respondents said they are “satisfied” or “very satisfied” with their total compensation, only 22 percent rated themselves as “satisfied” or “very satisfied” with their job overall.

“If a company has a toxic company culture, you couldn’t pay me enough to endure that,” said one technician in an online poll. “Work environment is more important than compensation.”

Copier Techs by the Numbers

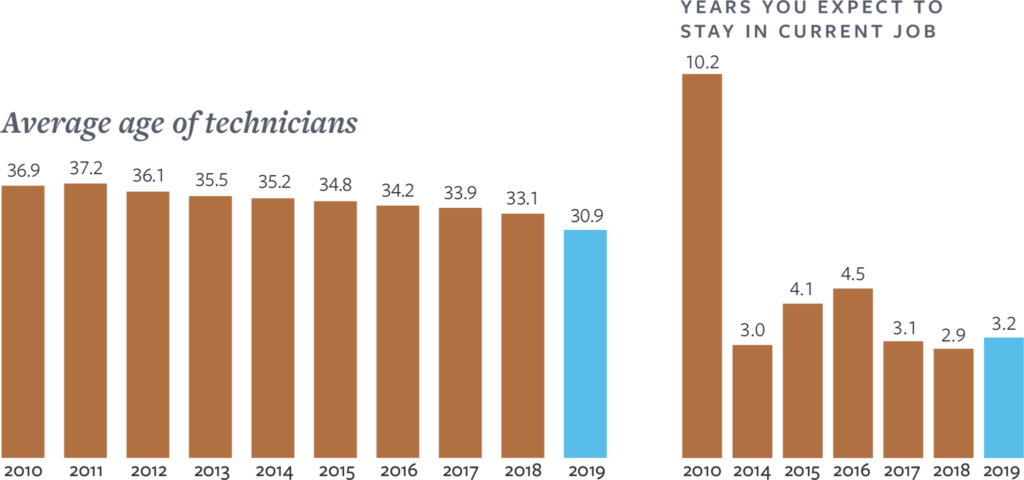

On average, the age of Copier Channel service techs is a bit younger in 2019 at nearly 31 years old, a decrease of nearly two years since 2014. In 2019, copier techs report having worked in the Copier Channel for 6.3 years on average.

Thirty-one percent of respondents said they work for an IT/MNS service organization; 27 percent work for a regional dealer with more than one location; 23 percent work for an independent dealer with one location; 16 percent work for an OEM; 2 percent work for a national service organization; and 1 percent work for a third-party service organization.

Educational achievement did not vary from a year ago: 49 percent of techs have a high school diploma, 13 percent some college, 24 percent OEM training, 15 percent tech or trade school and 0.5 percent an associate’s degree.

Nearly two-thirds of technicians (63 percent) describe themselves as field service techs, 35 percent identify as senior lead techs or team leaders and 2 percent of respondents described their job as house technician.

On average, copier techs work 52 hours per week, a decrease of one hour over 2018. They reported spending an additional eight hours each week on-call after hours, a one-hour increase from 2018. And techs say they only expect to stay in their current job for 3.2 years, which is 1.3 years less than in 2016 and 6.8 fewer years than in 2002. Asked if they plan to leave their current job, 94.3 percent of techs who responded to this year’s survey said yes.

What is causing the downward trend in the age of technicians and their unwillingness to commit to their employer long term? Crowley says there are several factors. “In the past five years, a lot of people retired or didn’t want to evolve with the industry, so they left.” They were replaced with younger workers, so the average age declined.

Crowley also notes that Millennial and GenX techs have different work-life goals and are less likely to make a lifetime commitment to any job. The greatest factor is the continuing level of change in the industry. “With the acquisitions in the direct manufacturer level and also the independent dealer channel, a lot has changed,” she says. “Compensation may change. Management may change. Territories may change. That causes them to take a look at other positions.”

2019 Salary and Benefits

Copier techs reported that on average their salary and bonuses increased to $48,590 and $6,460 respectively in the past year, an increase of 2.5 percent. The top non-cash indirect rewards remain about the same as last year. Of technicians who took the survey, 99 percent reported receiving health benefits and certification reimbursement as the top non-cash rewards.

The top sources of cash bonuses also mirrored last year’s responses, with 100 percent of survey respondents affirming they were rewarded for certification and training. Eighty-four percent of respondents reported receiving a retention bonus, an increase of 3 percentage points. Signing bonuses ticked up 7 percentage points, to 61 percent of respondents.

More frequent retention and signing bonuses are an indicator of how tight the market is for qualified technicians. Schwartz said this is as tight a market as he has ever seen. “It’s a rapidly growing marketplace and candidates are like homes with multiple offers.”

“You can trace it back to the recession, when dealers started doing less with more, and it seems like they never evolved out of that mindset,” he said. “Right now, hiring for bench strength, proactively hiring and bringing new people into the industry is not happening to any huge degree.” To fill the backlog of jobs, he said, the industry needs to rethink how it attracts and trains techs.

“It’s not only an IT skillset. There is a break-fix skillset involved, too. A copier has about 2,500 parts, so you have to teach someone how to service all of these devices and also have the skills to work on IT troubleshooting,” he said. “For some dealers, it’s hard to transition people from a strictly IT background into solving issues with Copier Channel devices.”

Recruiting. Retention. Counteroffers.

With a strong economy and abundant opportunities, it’s not surprising that technicians are exploring their options. The question Schwartz and Crowley say employers need to ask themselves is what would it take to inspire techs to turn their career path toward the Copier Channel?

“The Copier Channel is more interesting and varied, but this skillset easily transfers over to IT,” Schwartz said. “These folks have options outside of the industry.” That is why he said dealers have to be proactive and address changing needs.

“Employers need to be in touch with their people and understand what their wants and needs are and what their professional goals are,” Schwartz said. “So, the employer has to be prepared and take that into consideration.”

The wrong move is to fall back on the counteroffer to retain staff. It’s easier in the short run, Schwartz and Crowley said, but it doesn’t resolve the underlying need of developing new talent, and it can create other tensions within the organization.

“We don’t believe that the counteroffer is the way to go for the candidate either,” Crowley said. “Management is going to throw in the kitchen sink to keep the person. But it’s in every candidate’s best interest to move forward when they decide to move forward.”

Counteroffers are risky. A nice raise is always a good thing, but if techs want to move because of work issues, such as conflict with their manager, they will still face that situation day after day. At the same time, the company might feel it was held up. Recruiters say that 80 percent of those who accept a counteroffer will leave or be let go within a year. Our white paper, “The Five Reasons You Should Never Accept a Counteroffer,” has more details.

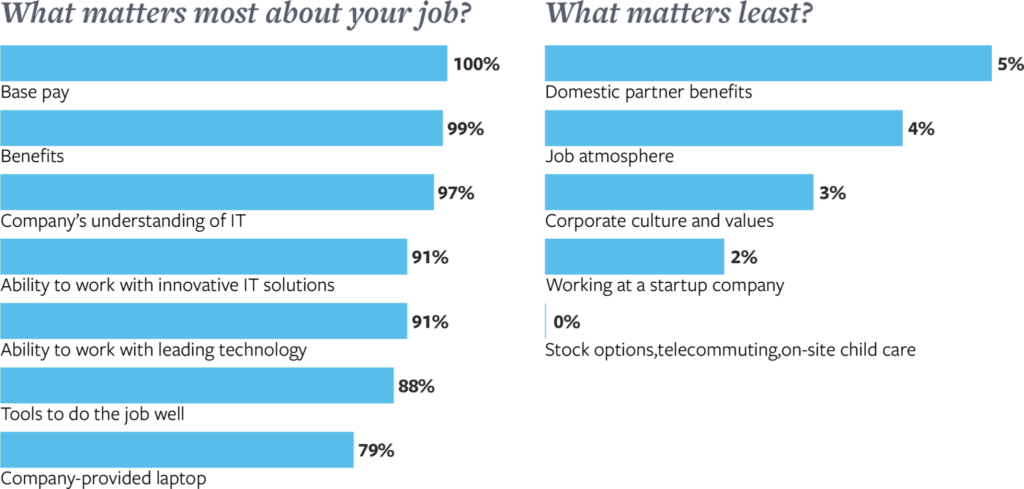

With abundant prospects, copier techs have increased interest in what matters most about their job. Asked to choose seven things that matter most from a list of 38 work variables, base pay and benefits topped the list. But other factors rose in importance, such as wanting to work with innovative IT solutions, up 9 percentage points, and having the tools to do the job well, up 7 percentage points. Other factors that rose on techs’ list include:

- 77 percent are concerned about the effectiveness of their immediate supervisor, up 8 percentage points

- 71 percent want skill development or educational opportunity, up 10 percentage points

- 58 percent are concerned about the prestige/reputation of their company, up 7 percentage points.

Work-life issues such as on-site childcare, stock options and telecommuting were not priorities for techs who took this year’s survey, but their responses show that “what matters most” might be changing:

- 33 percent are concerned with geographic location, a jump of 29 percentage points from last year

- 33 percent want to better understand the company’s business strategy, up 7 percentage points

- 28 percent are concerned about commitment to quality work throughout the company, up 10 points.

Reading the Tea Leaves

As the industry continues to evolve at warp speed, it would be cavalier to ignore the obvious: Efforts to attract qualified techs did not keep pace with the phenomenal growth in the industry in the past decade. Now the industry faces a new challenge. It needs to open a new pipeline to bring skilled, capable hybrid techs into the industry.

In 2019, it should be every dealer’s top priority to recruit and train hybrid techs. Not doing so could stall the industry’s incredible forward momentum. It is also time to ensure that current techs are getting the training, resources and support they deserve, so they won’t look for another opportunity or leave the industry.

“I have some great benefits where I am. But if I had the chance for a promotion, I would consider a change,” said one tech in response to an online poll about what would motivate a job change. “Where I am currently, there is no opportunity to move up.”

The online commenter ended with a sentiment that many techs might be feeling in 2019: “We are in a good place but not growing the way I feel we should. And I know I bring a lot to the table and am relied upon to do more than our average technician.”

In 2019, more than half of techs who responded to our survey said they are satisfied with their compensation, but a greater number rated themselves as dissatisfied overall.

What is the source of that dissonance about work? Schwartz said it’s a reflection of ongoing change in the industry and technicians’ aspiration to keep up with change.

“Because the channel keeps growing, they realize if they want more of a future in this industry, they have to get more knowledge,” he said. “When they are analyzing roles, they know that if this is what I am going to do, I have to evolve.”

In addition to concern about opportunities to learn and keep up with change, Crowley said, techs also are frustrated by benchmarking that doesn’t address client satisfaction or a job well done.

“It’s all about numbers. If management is only focused on the number of calls and not the complexity of calls or doing a fix right the first time, techs feel their efforts aren’t appreciated,” she said.

That is, in part, why 76 percent said they are looking for a new job in this year’s survey, up 4 percentage points from last year. The top reasons remain the same: Techs want better compensation, and opportunities are too good to pass up.

One online poll respondent put it this way: “In the current environment, the challenges and pressure to perform are at their peak. The use of soft recognition is nice, but the lack of financial recognition is sorely missed.”

This year, 35 percent of survey respondents also said they are looking for more interesting work, moving it into the Top 5 reasons techs are looking for a new job. Altogether, survey responses show that techs know it’s a candidate’s market and they are looking.

Don’t let the perfect get in the way of the practical. Be willing to take candidates with some skills and train them on the rest.

An Attracting and Retaining Crisis

Rapid growth, success and profitability in the Copier Channel over the past decade have a big downside. There simply aren’t enough hybrid techs to keep dealers fully staffed and clients happy. That is the reality sandwich that the industry is having for lunch a lot in 2019.

“It’s the decrease in the amount of people that are available,” Crowley said. “It’s not that the company is not out there looking, because they are looking. But it’s the reality that if a technician leaves one company and goes to another, who knows how long it’s going to take for that company to fill that position?”

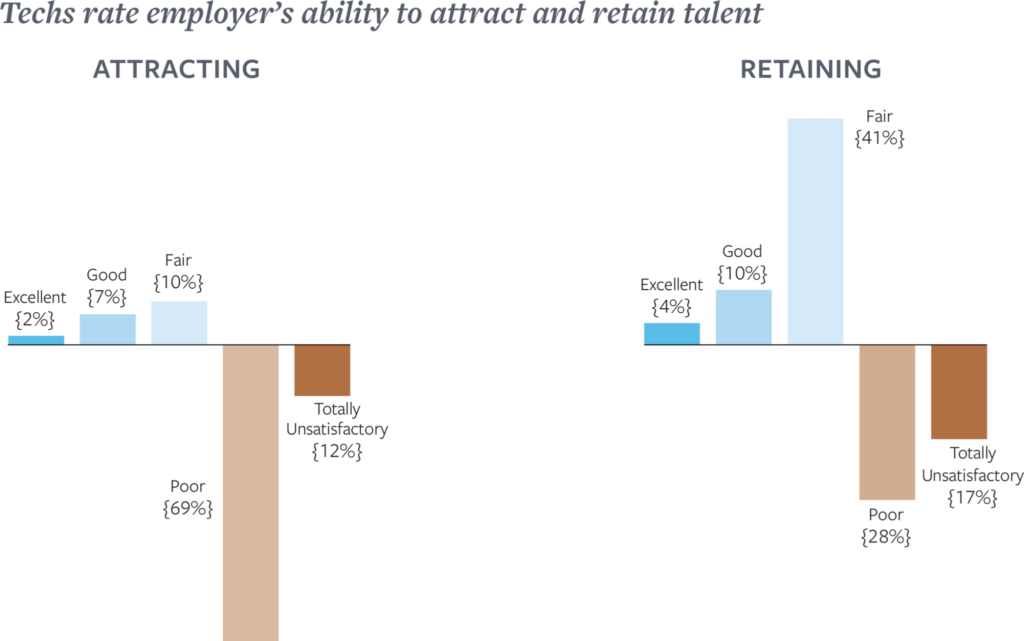

That difficulty in filling an open job can leave the remaining technicians picking up the slack and feeling unappreciated, which could turn them into a flight risk. In 2019, 81 percent of techs gave their employers a failing grade at attracting talent. On retaining employees, slightly more than half of respondents (54 percent) gave employers a passing score.

Schwartz said there aren’t enough people with the right skills in the pipeline, and it’s time to run a system check on how to attract talent to the industry. It starts with facing a cold reality. “Assume there is going to be turnover. That’s your future,” he said.

“In this highly specialized industry, you need to invest in people, because replacing them is not easy,” he said. “And don’t let the perfect get in way of the practical. Be willing to take candidates with some skills and train them on the rest.”

Assume there will be turnover… qualified candidates will move more quickly… you will need to beat their employer’s counteroffers. This job market is on steroids right now.

Toward a New Model of Training and Hiring

“Someone has to start a new pathway.” That is how Schwartz sees the near future for recruiting and training hybrid techs for the Copier Channel. “At one time, there were alternative pathways to get in the door: training schools, people would bring on trainees,” he said. “Everyone wants pre-certified OEM techs, but as the industry continues to grow, it needs to figure out how to grow talent.”

After nearly 30 years of recruiting in the Copier Channel, Schwartz sees an urgent need for dealers and manufacturers to evolve their process of finding, hiring and bringing new hybrid techs aboard. “My message to employers is simple,” Schwartz said. “The personnel shortage is an issue, and it will hurt your business unless you stay proactive.

“You need to assume there will be turnover. Assume qualified candidates will move more quickly, and assume you will need to beat their employer’s counteroffers. This job market is on steroids right now — you have to act accordingly.”

Steroids? Consider this. Responses to this year’s survey show that techs expect to stay in their current job only about three years. They report staying only 2.5 years with their last employer. The incoming talent pool? Nearly empty. Said Schwartz: “It’s time for employers to step up to fill the gap.”

Despite that reality, Schwartz is optimistic that this dynamic industry has the resources and know-how to solve the problem and seriously build bench strength. It’s something that the industry has handled well in the past.

“Twenty years ago, I used to see ads that said, ‘Just bring your raw skillset and we will train you.’ I think that business owners and service managers are going to have to do something like that again. They are going to have to ramp up training and grow hybrid techs.”

Until then, the market for hybrid techs will be extremely tight. That makes 2019 the time to start another Copier Channel evolution. This one focused on bringing more techs into the industry and creating a much deeper talent pool. -CC