Analysis

2018 Sales Manager Salary Survey

Copier Channel™ sales managers are working more hours, supervising more people and earning slightly more compensation than last year. In our 2018 salary survey, 57 percent of sales managers who took the survey said that overall they are “satisfied” or “very satisfied” with their job. At the same time, 93 percent said that they are looking for a new job, an increase of 2 percentage points over last year.

The results offer clues about why 93 percent of those who took the survey are open to new opportunities. When asked what “matters most to you about your job,” 88 percent of respondents said the company’s “understanding of the importance of IT.” Asked why they are looking for a new job, 55 percent of respondents said they are looking for a “more dynamic company.” Although neither answer was respondents’ top choice, “the importance of IT” rose 17 percentage points over last year’s survey, and a “more dynamic company” was up 6 percentage points. This indicates that sales managers want a workplace that understands and engages with the latest IT solutions.

“They have taken a big turn,” said Paul Schwartz, president of Copier Careers®. “Over a few years, the business has gone from selling hardware one piece at a time to really embracing and selling a wide range of IT-based solutions with long-term leases. Now, they are saying IT-solutions are the core of our business.”

The 2018 Sales Manager Salary Survey

Each year Copier Careers, the only nationwide recruiting firm dedicated exclusively to the Copier Channel, has asked professionals from across the industry about their compensation, job satisfaction and other work-life issues. This year 1,489 Copier Channel sales managers participated in our survey, an increase of 141 participants, or 9.5 percent. Their responses reflect the challenges and opportunities sales managers see in the now mostly IT-based channel.

Copier Sales Managers by the Numbers

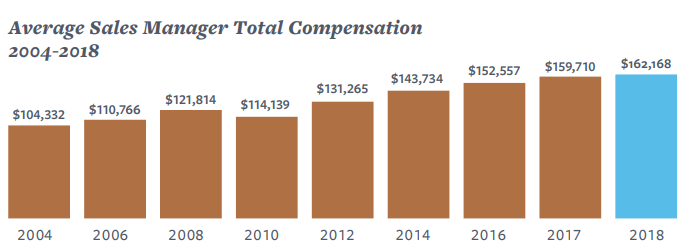

The average total compensation among the 1,489 sales managers who took our online Sales Manager Salary Survey this year increased $2,458, or 1.5 percent from last year, to $162,168. Traditional sales managers and selling sales managers both are represented in our survey.

While salary and benefits always top the “most valued” list, this year sales managers expressed a deepening focus on work priorities and technological advances:

- 99 percent of respondents said they want to create innovative IT solutions, an increase of 9 percentage points

- 98 percent expressed a desire to work with leading-edge technology, an increase of 7 percentage points over last year

- 89 percent want to be recognized for a job well done, an increase of 4 percentage points

“Sales managers understand that their job is to help the company achieve its goals,” said Jessica Crowley, business manager and senior recruiter at Copier Careers. “The more they are involved with IT solutions and services — being able to teach their team how to identify, sell and support the IT solutions — the more they can benefit the overall company.”

The good news for Copier Channel sales managers is that their average compensation compares well with the national median for sales managers. A report by U.S. News & World Report put the national median for all sales managers at $117,960 in 2016.

2017 Salary and Benefits

The average base salary for a Copier Channel sales manager rose to $63,408 this year (+1.2 percent), and on average commissions increased to $98,760 (+1.8 percent), for a total average compensation of $162,168 (+1.5 percent). The relatively flat compensation could explain why satisfaction with total compensation remained the same as last year’s survey.

“My company’s base pay for sales reps and managers is very, very low, and they don’t pay commissions on time to the reps,” said one industry pro in an online comment.

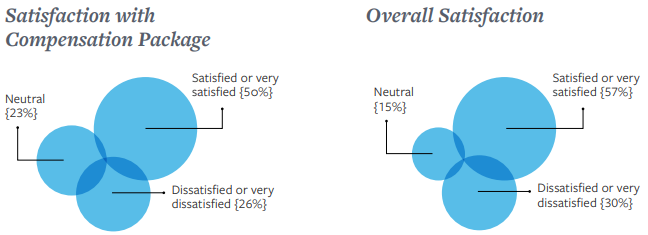

Among those who took the survey, 50 percent said they are “satisfied” or “very satisfied” with their total compensation, identical to last year’s survey results. Twenty-six percent were “dissatisfied” with compensation, with 23 percent of respondents “neutral” on the question. While the responses remained steady, half of the respondents expressed some level of dissatisfaction with their compensation — opening the possibility that a more competitive compensation package could be enough to lure them away.

However, 57 percent of respondents said they were “satisfied” or “very satisfied” with their overall job satisfaction. This 7 percentage point difference between total compensation and job satisfaction shows that many sales managers consider factors beyond compensation when evaluating their job satisfaction. Another 30 percent said they “dissatisfied” or “very dissatisfied” with their position, and the remaining 15 percent of respondents were neutral on their overall satisfaction.

Of those who took the survey, 99 percent identified health benefits as their top non-cash/indirect reward, and 97 percent said they receive a car allowance or use a company car.

Asked the top reasons for earning bonuses, 97 percent of respondents cited personal performance; 77 percent said they received bonuses for certification or training, which was 25 percentage points more than last year; 61 percent received signing bonuses, an increase of 6 percentage points. Taken together, these can be interpreted as dealers’ efforts to retain and attract talent.

Changing Perspectives on What Matters Most

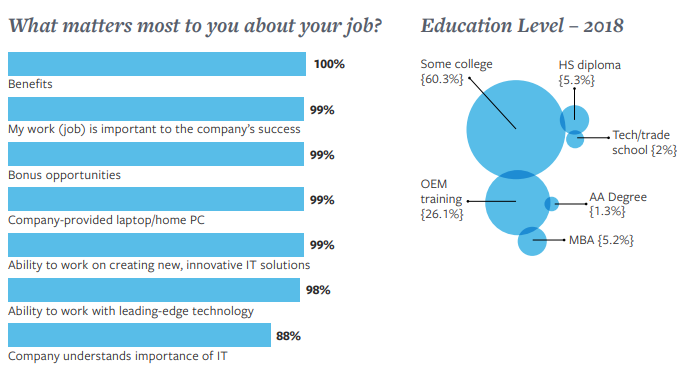

Results from the 2018 survey indicate that sales managers are reconsidering what they value at work and what they want from their employers to feel satisfied and appreciated on the job. Asked to choose seven from a list of 37 factors that “matter most about your job,” there were predictable responses, but several factors have increased in importance to sales managers.

As in 2017, 100 percent of respondents identified benefits as the thing that matters most to them. Almost everyone (99 percent) identified bonus opportunities as important, along with a company-provided computer and knowing that their job is important to the company’s success. But this year, sales managers are pointing to items further down the list as growing in importance to them. In essence, their responses create a how-to list for retaining sales managers:

- 99 percent want to work on creating innovative IT solutions, up 9 percentage points over 2017

- 98 percent want to work with leading-edge technology, an increase of 7 percentage points

- 88 percent want the company to acknowledge the importance of IT, up 17 percentage points

- 88 percent have increased interest in their company’s financial stability, up 3 percentage points

- 65 percent want the tools to do their job well, an increase of 3 percentage points

- 46 percent expressed interest in vacation/paid time off, up 2 percentage points

- 21 percent would like more skill development, up 4 percentage points

More Educated Leaders

Sales managers’ level of education increased slightly again this year. Just over 60 percent of those who responded to the survey said they have “some college,” up 2.4 percentage points, and there was an increase of 5.2 percent who said they hold an MBA. Other education categories remained stable.

Of those who took this year’s survey, 77 percent said they receive bonuses for additional training and certifications, an increase of 25 percentage points from last year.

On-the-job coaching and training are probably the most important to individuals and companies alike, said a Copier Channel employee in an online comment. “My belief is that it is a manager’s job to coach their employees to continuously improve and be the best they can be, in whatever responsibility area of the company that they manage.”

A Steadily Changing Industry

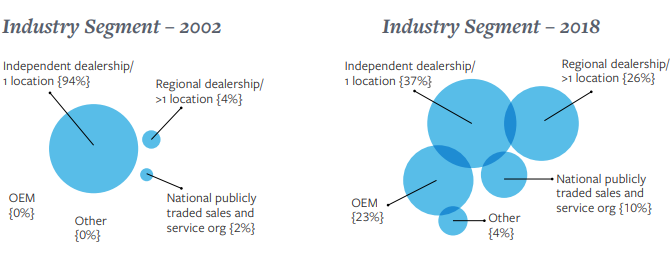

Of the nearly 1,500 sales managers who took this year’s survey, the plurality work at an independent dealership with one location (37 percent), followed by regional dealerships with more than one location (26 percent), OEM (23 percent), national publicly traded sales and service organizations (10 percent) and other (4 percent).

These proportions have been steady in recent years, but comparing 2018 results with where sales managers worked 16 years ago reveals a dramatic change. Since we first began taking this survey in 2002, there has been a steady decline in the number of independent dealerships with one location. In 2002, 94 percent of sales managers who took the survey said they worked at an independent dealership. By 2012, only 49 percent reported working for an independent dealer; in the past three years, the

proportion of those who worked at independent dealerships hovered between 39 percent and 37 percent.

“This change can be explained in two words: company acquisitions,” Crowley said. “As the industry has grown over the years, it has also become more consolidated.”

From 2002 to 2018, the proportion of sales managers who said they work at regional dealerships with more than one location increased from 4 percent to 26 percent.

Only 2 percent of sales managers said they worked at a nationally traded sales and service organization in 2002; their percentage stands at 10 percent in 2018’s survey responses.

OEM and third-party service organizations didn’t make the list until 2004, when 2 percent of sales managers said they worked for an OEM and 1 percent were employed by third-party organizations. Now, 23 percent of survey respondents say they work for an OEM. In 2018, zero respondents said they work for third parties. Sales managers only began to claim the “other” category to describe where they work in 2014 (2 percent); in 2018 their proportion has grown to 4 percent.

“This evolution in where sales managers work shows how IT has dramatically changed the Copier Channel,” Schwartz said. “As the industry has moved into the use of sophisticated solutions, the size of dealerships and the number of sales reps and technicians they need to support solutions has driven these changes.”

“Every owner that I talk with says finding and retaining people is their No. 1 problem.”

Supervising More People in More Places

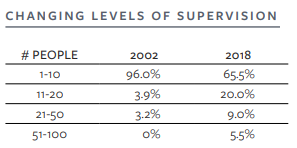

Another indicator of the Copier Channel’s evolution is in the number of people that sales managers supervise, which tracks closely with the rise of multi-location dealerships since 2002. In 2018, nearly two-thirds of survey respondents said they supervise 1-10 people, but that proportion declined from 95. 8 percent in 2002 to 69.3 percent in 2017 and 65.5 percent of respondents this year.

With the growth of regional dealerships, this year’s survey shows a corresponding increase in the number of employees being supervised. Those who manage 11-20 people increased slightly, from 19.6 percent in 2017 to 20 percent this year. The largest change was among sales managers who supervise 21-50 people. Their proportion increased from 6.8 percent in 2017 to 9 percent this year. The proportion of sales managers who supervise 51-100 people rose from 4.3 percent to 5.5 percent this year.

The Never-Ending Workweek

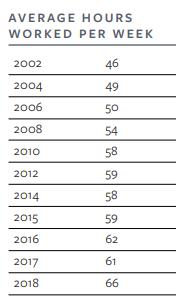

In 2018, sales managers are working on average 66 hours per week. This 20 is hours more per week than they worked in 2002, when they reported working 46 hours a week, and an increase of five hours a week from last year.

“The sophistication of the solutions” is one reason, Crowley said. “There is so much competition, because everyone sells everything now. They have to know the products. They have to train staff. They have to keep their team productive to be successful in selling.”

Other factors that contribute to a long workweek for sales mangers are increasing

responsibility to train their sales team to keep up with technological advances. They also spend a lot more time recruiting. As the industry has grown, the pool of available, qualified job candidates has shrunk. In this job-seeker’s market, sales managers spend more time recruiting — even when it adds hours to their workweek.

“Every owner that I talk with says finding and retaining people is their No. 1 problem,”

Schwartz said. “We see that in our work, too. It takes more time and effort to find qualified candidates than it did 16 years ago.” He said that is why it’s more important than ever for dealers to seize the opportunity to hire solid performers when they are available.

“You can’t keep a great candidate waiting while you think about it, or someone else will snap them up,” he said, noting that the time and effort required for managers to find and make those opportunistic hires can be considerable.

In 2018, sales managers share a long workweek with their peers in other industries. An article on the Hub Spot blog says the “28 percent of sales managers/VPs are working more than 60 hours per week” and 72 percent work evenings and weekends.

Perhaps it is not coincidental that respondents to this year’s salary survey expressed slightly more interest in vacation/paid time off. Forty-six percent identified this as something that matters about their job, an increase of 2 percentage points over 2017.

Well-Paid and Ready to Go

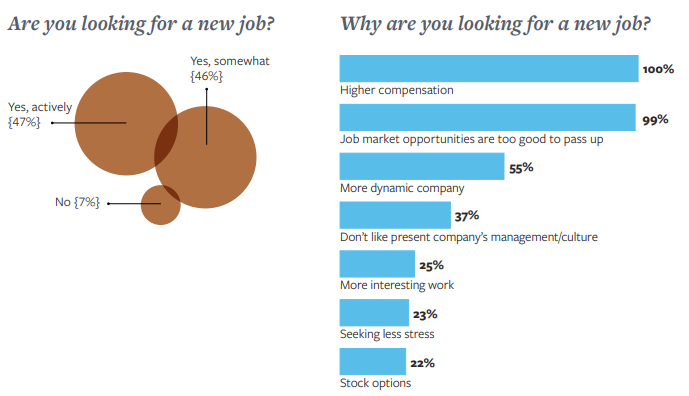

Of the sales managers who took this year’s survey, 93 percent say they are looking for other opportunities — 47 percent “actively” and 46 percent “somewhat,” an increase of 1 percentage point on each measure. Only 7 percent of those who responded to the survey said they are not looking for work, a decrease of 2 percentage points from last year.

Higher compensation remains the top reason sales managers are willing to explore their options, with 100 percent of respondents citing this reason. Second on their list is “job market opportunities too good to pass up,” at 99 percent.

In a dynamic industry, abundant opportunities have made it a job seeker’s market for sales managers, too. This creates an imperative for employers to increase or renew efforts to retain sales managers. A failure to address retention is to risk the hassle, instability and loss of revenue that comes with finding a replacement. Clearly, there is a natural inclination to see what’s out there, but this year’s survey responses offer a number of quality-of-work issues that could increase retention rates, if addressed.

For example, 55 percent of respondents want to work for a “more dynamic company,” an increase of 6 percentage points; 25 percent of respondents are looking for “more interesting work,” a 4 percentage point increase; 23 percent are “seeking less stress,” and 22 percent want “stock options,” both up 3 percentage points in this year’s survey.

Copier Careers recruiters say that the underlying reason for much dissatisfaction among sales managers is a perceived lack of support from the company. “If the owners aren’t supportive or are outright absent, that will drive your sales managers to find a company that will support them,” Schwartz said.

“Supporting sales managers means backing their vision for how they want to lead their team,” Crowley said. “It means having ownership trust their ideas and strategies for building their sales force, rather than questioning every decision. It means giving them the space to really thrive and succeed in that position.”

The survey shows that sales managers are rethinking what they want in the workplace as the industry continues to evolve. Retaining them will likely require a combination of increasing their satisfaction, not only in total compensation but also with opportunities to learn, grow and feel supported in their role.

“As recruiters, we know the best predictor of success is past performance. It’s really the same for the industry as a whole. The industry figures out challenges and keeps growing.”

Good Times, New Challenges

In 2018, sales managers are earning more, working hard and have increased responsibilities in a booming industry. Overall, they are satisfied with their total compensation and a majority say they like their job. Still, more than 90 percent of those who took the survey say they are looking for new opportunities. That isn’t as surprising as it might seem on the surface. In a go-go industry, with a high demand for talent, everyone is likely to size up their options and opportunities.

Clearly, the industry’s 10-year growth spurt has changed almost everything, and sales managers have been on the leading edge of this evolution and the challenges it has created — especially the laser-focus it now takes to find and hire qualified candidates. But adapting to change and difficult circumstances is nothing new for the Copier Channel.

“As recruiters, we know that the best predictor of success is past performance, it’s really the same for the industry as a whole,” Schwartz said. “Staffing issues across the industry are a challenge right now, but past experience tells us that the industry figures out challenges and keeps growing.”

In the past decade of rapid change, sales managers and the Copier Channel have been very resourceful, resilient and incredibly adaptable as the industry embraced a new IT-based business. The industry not only embraced sophisticated IT solutions, it ran with them, bringing more growth and some new challenges. One of which is to take some time to survey the new landscape.

In this year’s survey, sales managers have expanded the list of work-life factors that they see as important to job satisfaction. In doing so they are offering dealers a recruiting road map. This is a time to pay attention. Growing interest in factors such as a desire for training, the tools to do the job well or the ability to create innovative solutions might foreshadow where the industry is headed.

For dealers, being responsive to employees’ interest in these factors will make the difference in retaining and recruiting talent. It will also make it easier to find and hire a new generation of Copier Channel pros. Making small adjustments now will keep satisfaction strong and help generate even more growth in this ever-changing business, and everyone wins. -CC

Stay Tuned for Our Other 2018 Salary Surveys

- August Service and Operations Managers Salary Survey

- December Sales Representatives Salary Survey

In Case You Missed It

- Check out our 2018 Copier Tech Salary Survey

ABOUT US

Copier Careers® is a recruiting firm dedicated exclusively to helping Copier Channel employers find experienced service techs, copier sales reps, sales managers, service & operations managers, controllers, back-office staff and MPS/MNS experts. Learn more about our commitment to the Copier Channel at CopierCareers.com or call 888-733-4868 to talk with a recruiter.