Analysis

2017 Sales Representative Salary Survey

After a decade when Managed Print Services and Managed Network Services changed almost everything in the Copier Channel, sales professionals have emerged in a good spot. They have embraced an array of new products and services, adapted to changes in compensation packages and quotas, and they are succeeding at selling and delivering complex solutions.

Respondents to our 2017 salary survey indicate that compensation has leveled out, and more sales professionals than ever identify themselves as MPS/MNS specialists. In a year when base salaries remained flat, sales professionals maintained their earning power by making or exceeding quotas. This indicates that dealers might have found the sweet spot on compensating MPS/MNS sales.

In the sixth year of our Sales Representative Salary Survey, we see good things ahead for Copier Channel sales pros, including a sustained demand for savvy sales professionals across the industry. The highest demand is for “hunters,” who are skilled at finding new business for dealers. However, there also has been an increase in the use of non-compete agreements across the industry, which can hamstring talented sales pros from moving on or up.

2017 Sales Representative Salary Survey

Over the past 15 years, Copier Careers, the only nationwide recruiter devoted exclusively to the Copier Channel, has conducted annual salary surveys for key positions in the industry, including service technicians, service and operations managers, and sales managers. In 2011, we added a salary survey for copier sales representatives. This year 10,406 Copier Channel sales representatives from across the industry participated in our survey.

Copier Sales Representatives by the Numbers

With Managed Print Services (MPS) and Managed Network Services (MNS) here to stay, sales reps are at the heart of an industry that has experienced incredible growth and the advent of a plethora of new services and solutions in the past decade. Sales pros from all types and sizes of copier businesses in the Copier Channel responded to this year’s survey. Respondents included:

- 1,934 Account Executives

- 1,965 Named Account Managers

- 1,025 Senior Account Executives

- 1,010 Major Account Managers

- 409 Government Account Managers

- 309 National Account Managers

- 3,754 MPS/Solution Sales Representatives

| Over the six years this survey has been conducted, the number of sales professionals who identify themselves as account executives has declined, but there has been an increase in those who identify as MPS/Solutions Specialists. Account Executives aren’t leaving the industry, but they have begun to describe their skills and work responsibilities in a different category in the now IT-solutions-based industry. |

“It’s all about balance. Dealers set the base salary low enough to keep sales reps motivated to keep selling.”

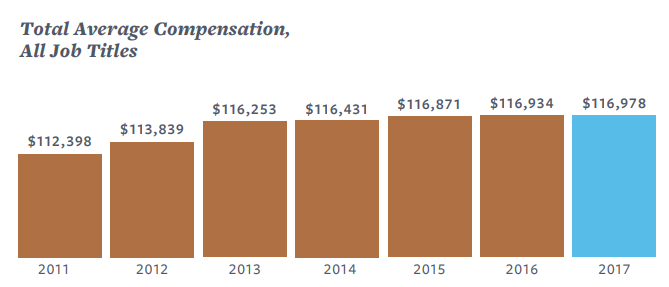

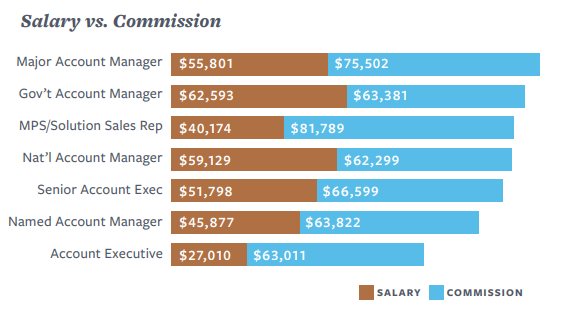

Compensation Remains Flat but Signals Stability

In 2017, respondents to our salary survey indicated that the needle barely moved on total compensation across all sales job titles. This mirrors results of last year’s survey, but it also shows no significant dip in total compensation for 2017:

- The average annual base salary for copier sales professionals was $48,912, an increase of a little over $20 from 2016

- The average sales rep commission reached $68,066, an increase of $23.43 since last year

- The average total compensation increased to $116,977, which is $43.57 more than in 2016

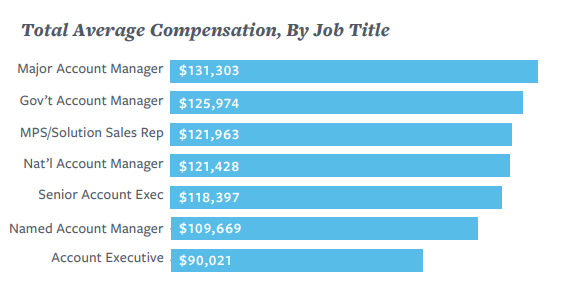

Across individual sales job titles, compensation also remained flat in 2017:

- Major Account Managers again reported the highest average income, $131,303, an increase of $5 over last year

- Government Account Managers reported the second highest average income, $125,974, down $2 from last year

- MPS/Solution Sales Representatives made $111 more than last year for an average compensation of $121,963

- National Account Managers reported an average increase of $5 and an average income of $121,428

- Senior Account Executives reported a $27 increase to bring average compensation to $118,397

- Named Account Managers took home on average an additional $18 for an average income of $109,759

- Account Executives had an average increase of $141, bringing average compensation to $90,021

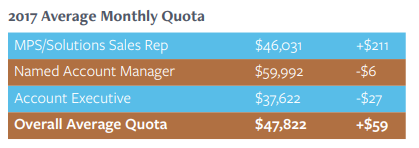

Quotas Remain Steady and Within Reach

Across the industry, competition has lowered profit margins, and that has had a direct effect on compensation. For sales reps that means they have to sell more. Responses to the 2017 salary survey indicate that sales representatives are doing just that.

“These people are hitting their quotas, so they are doing well,” said Paul Schwartz, president of Copier Careers. “They are reporting pretty healthy quota numbers.”

Jessica Crowley, business development manager and senior recruiter at Copier Careers, said there are a couple of factors that have kept compensation flat over the past couple of years.

“It’s all about balance. Dealers set the base salary low enough to keep sales reps motivated to keep selling,” she said. “Sales reps aren’t in it for the base salary, they’re in it for the total compensation package.”

Crowley said part of the compensation dance is that sales reps and the dealers are also still figuring out how to separate themselves from the crowd, when dealers across the industry are offering very similar MPS and MNS products and services. The competition drives down margins and affects sales. Even so, Crowley said that she finds that sales reps are fairly happy with their opportunities and compensation overall.

“Sales reps know that they have options, and if they can sell, they know they can go somewhere else,” she said. “Often, they aren’t actively looking to make a change, but they will consider an interesting offer.”

“ For experienced sales reps, compensation is a measure of their sales success. They want a potential employer to have that information.”

Adding to the complexity of recruiting in the Copier Channel in the past couple of years are two issues that can make vetting and placing a candidate more difficult: non-compete agreements and state laws that restrict employers from asking candidates about salary history.

Even though non-compete agreements aren’t new to the Copier Channel, recruiters at Copier Careers report hearing about them more frequently in recent years, with terms that are more stringent than before.

According to a recent article in Fortune magazine, 47 states now allow non-compete agreements, which can make placing candidates a bit trickier at times.

“We always advise applicants and potential employers to have legal counsel review a non-compete,” Schwartz said, noting that in general non-compete agreements are an effort by businesses to hang onto great sales reps and to guard hard-won territory.

“The employer’s side is that they have invested in you. You developed your skills and customer relationships with their organization, and they don’t want you to take a book of business and walk out the door,” he said. “On the other hand, telling a departing employee that they can’t work in the field for years is unreasonable.”

To address the issue, recruiters at Copier Careers work to find a place where clients and candidates get something of what they need.

“We have seen compensation packages that pay a past employer a fee in order to release them from a non-compete agreement,” Schwartz said.

Another variable that can slow or complicate the recruiting process are laws in some states and local jurisdictions that deny employers the right to inquire about a candidate’s salary history.

“It has to do with gender equity and equal pay, and we appreciate those concerns,” Schwartz said. “For employers, sales reps are judged on what they have earned and what they have produced. Screening candidates for sales positions can be quite a challenge for employers, when they can’t ascertain a candidate’s past earnings.”

A recent article in Forbes says “the salary question” can have a tendency to hold down earnings, especially for candidates trying to advance to a new level or role. But for experienced sales reps, compensation is a measure of their sales success. They want a potential employer to have that information.

“Our job is to get an understanding of the candidate’s overall training and experience and past success to determine if it aligns with what the employer is offering,” Crowley said. “I don’t want to waste the candidate’s time or my client’s time if their expectations don’t match.”

Short of being able to ask about salary history, our recruiters find other metrics to measure a candidate’s productivity and success, such as a monthly quota and performance against that goal, to demonstrate whether or not the candidate has the qualifications to move forward in a search.

Hunters and Farmers

In 2017, well-qualified sales professionals were the hottest commodity in the Copier Channel, and they will remain a staffing priority in 2018 and beyond. At Copier Careers, the No. 1 recruiting target is a “hunter” sales rep.

Hunters help drive business growth and are skilled at everything from making cold calls to delivering presentations, putting a proposal together and gaining the confidence of prospective clients. Success as a hunter requires a combination of self-confidence, persistence and knowledge about the industry.

“There is a premium on hunters because they are the people who produce new sources of revenue,” Schwartz said. “These positions are the hardest for employers to fill.”

A “farmer” in the Copier Channel is a senior sales rep who has a significant base salary and manages typically large, key accounts or works within a specific vertical. A farmer’s core job is to tend to those accounts and expand the portfolio and ensure continued client satisfaction.

Hunters and farmers contribute to the growth and stability of dealerships, but the high demand for hunters indicates that the industry needs to attract and grow sales talent. Considering candidates with a year or two of experience in the Copier Channel and training them is one approach, and recruiting candidates with B2B sales experience from a parallel industry is another. But the greatest effect on a dealer’s bottom line is making opportunistic hires when strong sales candidates are available.

“Industry employers need to have a sense of absolute urgency in hiring,” Schwartz said. “You can’t be too busy. You have to look at the candidate when they are there, because they won’t be available next week.”

Recruiters say that sales professionals are most likely to look for new opportunities when their expectations are not being met. This could be a change in territory, conflict with a sales manager, mergers and acquisitions, a change in compensation plan or poor service on solutions they have sold. That’s when they are open for a new opportunity.

“Identifying good sales reps is easy. Finding people ready to move is a challenge,” Schwartz said. “Experienced reps won’t be on the market for long.”

A Solid Year, Opportunities for Growth

After a decade of rapid change, the Copier Channel has its feet firmly planted in its new IT-based landscape. MPS/MNS solutions continue to create abundant opportunities for growth and prosperity. Steady sales numbers in recent years, indicate that the industry’s rapid expansion has slowed, but sales professionals continue to meet or exceed quotas. In 2017, the industry is on solid footing. The challenge ahead is to embrace ongoing change and new technology, find hunters to bring in new business and keep farmers on top of long-term relationships. It is also a critical time to find and train a new generation of sales professionals. The last decade has shown that the Copier Channel is a dynamic industry where sales professionals and other industry professionals can prosper and find long-term career success, and they are doing both. -CC

Our Other 2017 Salary Surveys

In Case You Missed It

- 2017 Copier Tech Salary Survey

- 2017 Sales Manager Salary Survey

- 2017 Service & Operations Manager Salary Survey

ABOUT US

Copier Careers® is a recruiting firm dedicated exclusively to helping copier channel employers find experienced service techs, copier sales reps, sales managers, service & operations managers, controllers, back office staff, and MPS/MNS experts. Learn more about our commitment to the copier channel at www.CopierCareers.com or call 888-733-4868 to talk to a recruiter.

2017 Sales Representative Salary Survey

© 2017 CopierCareers.com. Schwartz & Co., LLC dba Copier Careers®. All rights reserved.