Analysis

2017 Service and Operations Manager Salary Survey

Welcome to the new normal. In 2017, the Copier Channel finds itself in a new business landscape that emerged after a decade of rapid technological advances. Now that the industry is IT-based, it faces a new set of challenges that include updating business practices, aligning staffing, adapting workflows and improving internal processes to better serve clients.

That is apparent in the responses to our 2017 Service and Operations Manager Salary Survey. Responses this year show an evolved marketplace and an industry adjusting its work to a new business environment.

Everyone in the industry has scrambled to learn, sell, deliver and support the emerging information management services. Perhaps those most profoundly affected by this rapid change are service and operations managers, whose responsibilities include staffing, education, training and in-house collaboration to implement the array of new solutions and to coordinate that work with sales and the back office to best serve customers.

This is a sea change — a broad transformation — for the industry. While IT solutions will continue to advance, the survey shows how and where service and operations managers see the need for companies to keep pace with change.

2017 Service and Operations Manager Salary Survey

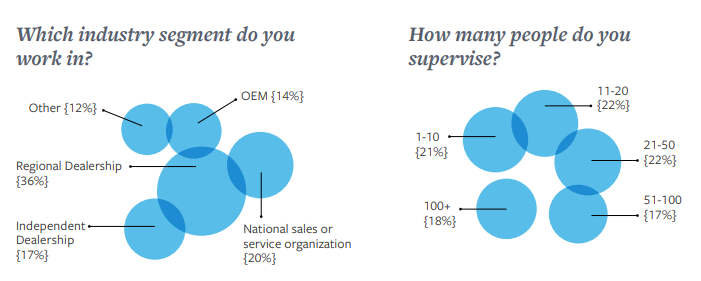

Over the past 15 years, Copier Careers®, the only nationwide recruiting firm dedicated exclusively to the Copier Channel, has asked professionals from across the industry about their compensation, job satisfaction and other work-life issues. This year 1,927 Copier Channel service and operations managers from across the industry participated in our survey, an increase of 63 participants. Their responses reflect an industry that faces ongoing challenges in an evolved IT-based channel.

Copier Service and Operations Managers by the Numbers

What is striking in the responses of service and operations managers to the 2017 survey is how little their opinions have changed since our 2016 survey. The takeaway? The industry seems focused on fine-tuning its response to its new IT-based landscape. Copier Channel leaders are adapting work processes and cross-departmental relationships to help their organizations thrive.

In 2017, service and operations managers increasingly expressed a willingness to work collaboratively across their organization:

- 66 percent say they want to work with “highly talented peers,” an increase of 15 percentage points over 2016.

- 61 percent say they want to feel “a sense of community in my work group,” an increase of 27 percentage points in the past year.

“Before managed print services and managed network services, sales and service operated in silos, and words like ‘community’ were not used by service managers or technicians,” said Paul Schwartz, president of Copier Careers. “Now, I think they realize that they are dependent on each other to be successful. These departments are not in silos anymore. They get it.”

Of those responding to the survey, 81 percent pointed to the effectiveness of their immediate supervisor as a concern — an increase of 10 percentage points since last year’s survey. This also could be a measure of frustration over a lack of resources to hire, train and retain staff to better service and support complex IT solutions.

Seventy-seven percent of respondents also expressed a desire to have “tools and support to do my job well,” which is also a measure of a commitment to effectively deliver service and support for new solutions.

2017 Salary and Benefits

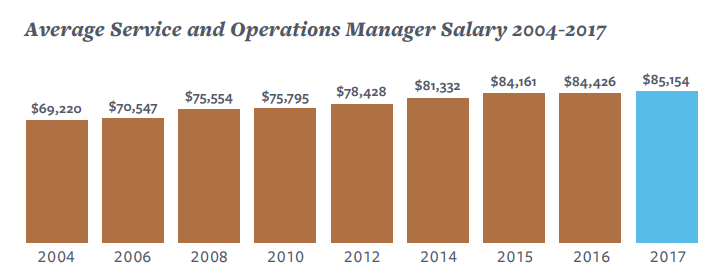

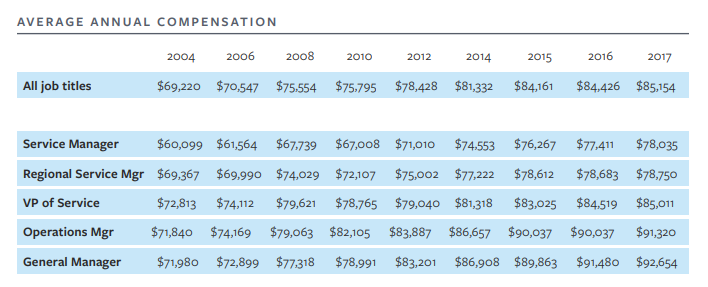

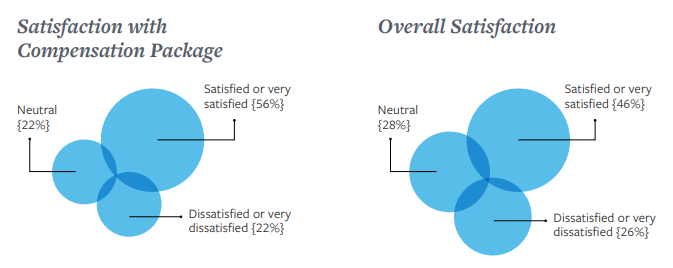

Of the service and operations managers who responded to the survey, 56 percent said they are satisfied with their compensation. The average annual salary across all job titles for service and operations increased to $85,154 in 2017, an increase of 0.9 percent in the past year. Non-cash bonuses, for health benefits, a company car, training, etc., increased 6.5 percent to a value of $28,654.88.

In 2017, the top non-cash benefits were health benefits and a company car/car allowance. Sixty-six percent of service and operations managers also noted they had received further education or training, an increase of 27 percentage points over last year.

Only 46 percent of survey respondents said they are “very satisfied” or “satisfied” with their jobs overall. Twenty-eight percent were “neutral,” and 26 percent said they are “dissatisfied” or “very dissatisfied.”

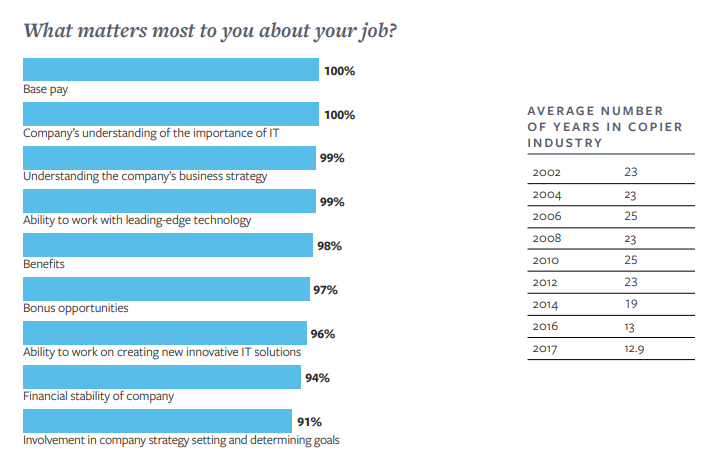

Most respondents seem to be looking past pay and benefits to measure satisfaction. More than 95 percent of respondents say they care about “the company’s understanding of the importance of IT,” want to “understand the company’s business strategy,” want “to work with leading-edge technology” and are eager “to work with creating innovative IT solutions.”

“Ten years ago, a service manager was a guy who knew the nuance of a device and had the mechanical skills to make it work,” Schwartz said. “Now they’re responsible for making sure that network solutions are implemented, that installs are implemented and everything flows. Everyone’s success depends on it, and that’s why they’re interested in strategy, team building and training.”

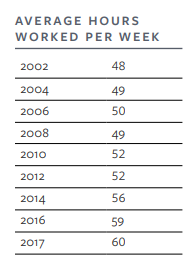

In 2017, service and operations managers worked an average of 60 hours per week, an hour more than they reported last year and 13 hours more on average each week than they reported working in 2002.

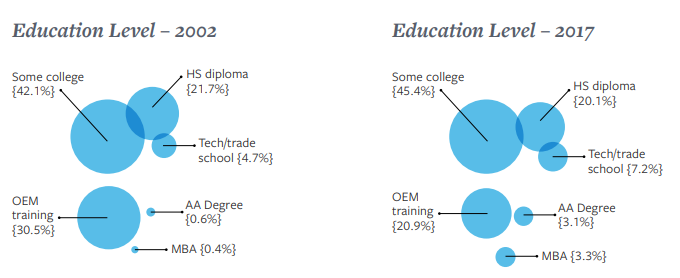

From 2002 to 2017, the educational attainment of service and operations managers also increased. In 2002, 42.1 percent reported having “some college” and fewer than 1 percent held an associate’s degree or an MBA.

In 2017, more than 45 percent have some college, 7.2 percent have tech/trade school training and more than 3 percent have an associate’s degree or an MBA.

“They need that education, because they are operating in a much more sophisticated environment,” Schwartz said. “The industry has just gone zoom in the last decade,” he said. “There are so many new products. They manage networked solutions, implementation and logistics. It’s an entirely different world.”

“The industry is on a learning curve about allotting resources, and ownership does not always want to give out a lot of resources.”

Even as the hours they put in each week have gone up slightly, the number of years that service and operations managers work in the industry has declined significantly, from 23 years in 2002 to 12.9 years in 2017.

“As IT solutions began to dominate the industry, a generation of longtime service and ops managers began to retire,” said Jessica Crowley, business development manager and senior recruiter at Copier Careers. “A new generation of managers, with a wider range of skills and education, were hired to lead the industry’s evolution to IT solutions.”

The generational shift is also reflected in how long service and operations managers expect to stay in their current jobs. In 2002, survey respondents said they expected to stay in their current job 11 years. In 2017, service and operations managers said they expect to stay in their job only five years. That aligns with U.S. Bureau of Labor Statistics data that indicate the average American worker now changes jobs every four years.

In the copier industry, some of the willingness to change jobs is driven by the swiftness of change in products, services and technology — and the frustrations it creates for service and operations managers.

“If service and ops managers are hired to implement technology and they haven’t been given the ability or authority to actually make the changes, then they will move to another job,” Crowley said.

One key issue is having a budget that allows the company to attract and hire qualified staff or to train existing staff on new solutions. It’s about resources — where to invest and how much to invest in training and staffing.

“The industry is on a learning curve about allotting resources, and ownership does not always want to give out a lot of resources,” Schwartz said. He noted there can be a high cost for failing to invest in training.

One survey respondent outlined the repercussions: “Without advancement of technical skill, the person is doomed. They become obsolete, then defensive, unreasonable, unreliable and unmanageable.”

What Matters Most? Almost Everything

When asked to identify seven factors “most important to their job” from a list of 37 variables, nine things were named by more than 90 percent of service and operations managers (table above). This included a juxtaposition of personal and professional needs “base pay” and “the company’s understanding of the importance of IT,” which were chosen by 100 percent of respondents.

In addition to the choices that were highly rated by more than 90 percent of respondents, there were seven variables that more than 60 percent of respondents rated as important to their job. This included:

- 88 percent want job stability

- 82 percent want to know their job helps achieve company goals

- 81 percent are concerned about the effectiveness of their immediate supervisor

- 78 percent are interested in the prestige/reputation of company

- 77 percent want the tools and support to do their job well

- 66 percent want to work with highly talented peers

- 61 percent say they want to feel a sense of community in their work group

“Our industry is promoting that it can provide everything to our clients,” Crowley said. “So, these managers want to be sure they have all the tools they need to do the job. If a company can’t provide it, that’s when we see people looking for something new.”

Oh, the Irony

Sometimes the problem sticks out like a sore thumb — in this case a thumb that is swollen, purple and has been aching for years.

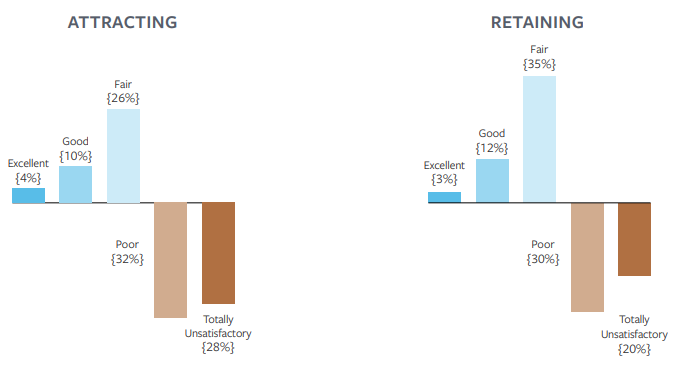

In the 2017 survey of service and operations managers, one thing is very clear. Many are dissatisfied with the industry’s ability to attract and retain employees.

- 60 percent of service and operation managers say that their organization does a “poor” or “totally unsatisfactory” job of attracting employees

- 50 percent of the managers said their company does a “poor” or “totally unsatisfactory” job of retaining talent

- 4 percent of these managers said their company does an “excellent” job of attracting talent

- 3 percent said their company does an “excellent” job of employee retention

Wait a sec. Aren’t these the very people charged with hiring and retaining employees?

“That is the frustrating part of it,” Crowley said. “We see a lot of companies trying to get techs certified on all of these networking software solutions, but they are paying them as field techs, not at the scale of what the industry has become — IT and network-focused.

A lot of times the service and ops managers have their hands tied, because they don’t have the budget to attract and retain talent.”

It’s a problem that is not only ironic but ongoing.

“It’s been this way forever,” said Schwartz, whose company has been recruiting in the copier industry for nearly 30 years. “This has always been the result in this survey. These are the people who can affect the change, and they’re responsible for it. But year after year, they report back that it’s not possible to change. So, the frustration continues.”

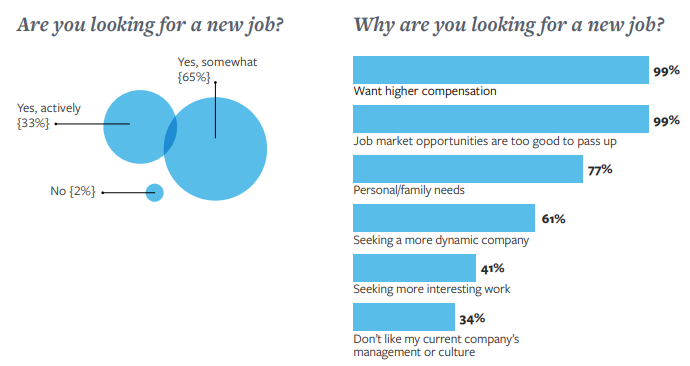

The vast majority of service and operations managers (98%) say they’re either “actively” or “somewhat” looking for a new job. Of those answering this year’s survey, 99 percent say they want “higher compensation” or they see “job opportunities that are too good to pass up.”

Three variables are driving service and operations managers to consider new opportunities, said Crowley, the business development manager and senior recruiter at Copier Careers. “The effectiveness of immediate supervision is something that comes up, then having the budget to hire and train their team, and they all want to work in leading technology.”

Without those key components job satisfaction declines and service and operations managers begin to look elsewhere. “The market is very competitive,” Crowley said. “If dealers don’t offer every type of solution, the sales reps can’t sell. When you sell a lot of solutions, the service team has to know how to implement the product; otherwise they’re going to fail miserably.”

“That is why sales and service have found they have a lot more in common than in the old days — a decade ago,” she said. “Their success is tied to each other’s performance, so they are working together for a common goal now.”

“People are more willing to change,” Crowley said. “It’s the new normal.”

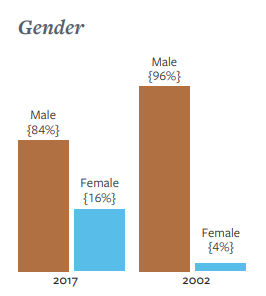

In 2017, the 15th year of the survey, one notable change is the number of women holding service and operations manager positions. Sixteen percent of respondents identified themselves as female leaders who work in the role, compared with 4 percent who said they held that role in 2002.

“I am pretty much amazed that sales and service have come to realize that they need each other.”

Recent changes in the Copier Channel have been meteoric, not glacial, and that certainly has caused plenty of discomfort and growing pains in the industry. But from that discomfort sprang some very positive outcomes. Take, for example, the new effort to push sales and service out of their silos to have them work together toward common goals — better coordination, improved service and happier customers.

Perhaps it is only a survival instinct, but it is an instinct that is strengthening the industry and propelling it ahead after a time of incredible churn.

“When you think about 2002 versus 2017, it’s the polar opposite,” Schwartz said. “ln 2002, we had organizations that had sales departments that literally didn’t know who was in the service department and vice versa.

As recently as 2014, attitudes were different. In an online poll July 25-Aug. 26, 2014, Copier Careers asked: In your organization do you feel that sales and service work together?

Of the 2,680 responses, 844 said “No — but if they did we would really have an effective organization”; 795 (30 percent) said “Yes, communication is key to our company’s success”; 751 (28 percent) said “Somewhat, just enough to get by”; and 290 (11 percent) responded “I wish they knew that the other one existed.”

“I am pretty much amazed that sales and service have come to realize that they need each other,” Schwartz said. “Now it’s very integrated. They want to work in a collaborative environment, and I think it’s very modern of them to have that realization.”

Certainly, more technology innovations are coming, but the newfound “community” within organizations is the best approach to manage ongoing change and adaptation. Instead of knowing where to “kick the machine,” evolved copier dealerships will need to know how to reach across departments and specialties to get the best results. A new generation of proactive and creative service and operations managers is critical to that continued evolution. Their task to hire, train and create a business environment open to new ideas and collaboration is how the industry will continue to grow and do its best work. The silos are gone. The era of collaboration has begun. -CC

Our Other 2017 Salary Surveys

- December – Sales Representatives Salary Survey

In Case You Missed It

ABOUT US

Copier Careers® is a recruiting firm dedicated exclusively to helping copier channel employers find experienced service techs, copier sales reps, sales managers, service & operations managers, controllers, back office staff, and MPS/MNS experts. Learn more about our commitment to the copier channel at www.CopierCareers.com or call 888-733-4868 to talk to a recruiter.

© 2017 CopierCareers.com. Schwartz & Co., LLC dba Copier Careers®. All rights reserved.